Key Takeaways

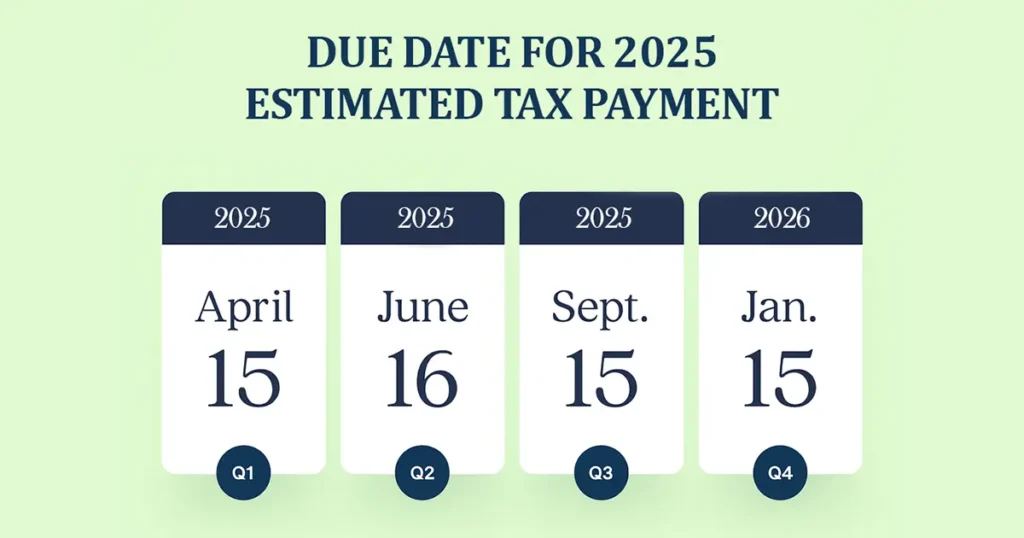

- Estimated tax payments for 2025 are due quarterly:

- Q1: April 15, 2025

- Q2: June 16, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026 (final payment for 2025)

- Full 2025 tax return must be filed by April 15, 2026, including any remaining taxes owed.

- Filing an extension moves the submission deadline to October 15, 2026, but taxes owed are still due by April 15, 2026.

- LLCs, self-employed individuals, and business owners have specific filing obligations; knowing deadlines ensures compliance and avoids penalties.

- Missing deadlines may result in fines, interest, and complications, but IRS relief programs and payment plans can help manage late payments.

- Consider professional tax services to simplify filing, ensure accuracy, maximize deductions, and stay on top of deadlines like quarterly payments, LLC filings, and 1099 submissions.

Key Tax Deadlines for 2025

The 2025 tax season is packed with important dates that every taxpayer needs to know. For most individual taxpayers, the tax filing deadline 2025 for the full return is April 15, 2026. States may have slightly different rules, so checking local tax authorities is critical.

Using the IRS tax calendar 2025 is a smart way to stay organized. It helps you track filing dates, estimated payments, and any special deadlines for businesses or self-employed individuals. Planning ahead can save both time and money.

When Are Estimated Taxes Due 2025?

Estimated taxes are payments made throughout the year by individuals who don’t have taxes withheld from their income, such as self-employed workers or freelancers. If you expect to owe $1,000 or more in taxes for 2025, you likely need to pay estimated taxes.

The IRS’s official 2025 estimated-tax form, Form 1040-ES, provides a clear schedule for these payments. As outlined in IRS Publication 509, individual taxpayers are generally required to make estimated tax payments on the 15th day of the 4th, 6th, 9th, and 1st months of the tax year. For 2025 income, this corresponds to:

- Q1: April 15, 2025

- Q2: June 16, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026

Paying estimated taxes on time keeps you in good standing with the IRS, prevents penalties, and allows for smoother financial planning.

When Are Quarterly Taxes Due 2025?

Quarterly taxes follow the same schedule as estimated taxes, but are especially important for self-employed individuals, small business owners, and anyone receiving income reported through a 1099 filing. Businesses that submit multiple 1099 forms also need to file Form 1096, which serves as a summary when submitting paper 1099s to the IRS. Paying taxes in four installments helps prevent a large lump-sum bill at the end of the year and keeps your cash flow predictable.

The 2025 quarterly deadlines are:

- Q1: April 15, 2025

- Q2: June 16, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026

In addition to quarterly taxes, businesses should stay on top of payroll obligations, deductible expenses, and other federal filing requirements to ensure full compliance. Maintaining a consistent payment schedule helps avoid penalties and makes tax season far more manageable.

When Are LLC Taxes Due 2025?

LLCs have unique tax responsibilities depending on how they are structured. A single-member LLC is usually treated as a sole proprietorship and follows the standard individual tax deadlines. Multi-member LLCs, however, are generally taxed as partnerships and must file Form 1065 by March 15, 2026, making their deadline earlier than individual filers.

In addition to federal requirements, many states impose their own filing obligations or annual LLC taxes. Staying organized and knowing both your federal and state deadlines helps you avoid penalties, interest, and year-end financial stress.

When Are Taxes Due With an Extension?

If you need more time to prepare your return, filing Form 4868 gives you an extension. The tax extension deadline 2025 is October 15, 2026, providing six extra months to file your 2025 return.

It’s important to remember that an extension only delays filing, not payment. Any tax owed must still be paid by April 15, 2026, to avoid penalties and interest. Extensions are useful for complex returns or situations where additional documentation is required.

For more information, visit the IRS on how to get an extension to file your tax return.

Read more: How to file a tax extension with Form 4868

What Happens if You Miss the Tax Deadline?

Missing tax day 2025 or the last day to file taxes 2025 can lead to costly consequences. The IRS may charge a failure-to-file penalty of 5% per month on the unpaid balance and a failure-to-pay penalty of 0.5% per month, along with accumulating interest. These penalties can add up quickly if not addressed.

The good news is that the IRS offers solutions. Taxpayers who communicate early may qualify for payment plans, installment agreements, or even penalty relief. In some cases, you can request penalty abatement by submitting Form 843, which is used to ask the IRS to reduce or remove certain penalties and interest.

When Is the Last Day to File Taxes 2025?

The final filing date for the 2025 tax year is April 15, 2026, unless it falls on a weekend or holiday, in which case the IRS may extend the date to the next business day. Filing on time ensures compliance and prevents unnecessary fines.

Even with an extension, all taxes owed are still due by the original April 15 deadline. Keeping track of these dates and marking them in a calendar or digital planner can help you stay on track and avoid last-minute panic.

Tips to Avoid Missing Tax Deadlines

- Set reminders early: Mark the first day to file taxes 2025 and all quarterly payment deadlines in your calendar.

- Organize financial documents: Keep W-2s, 1099s, receipts, and other important records in one place for easy access.

- Use professional tax services or software: Simplifies calculations, ensures accurate reporting, and helps you track deadlines like the 1099 deadline for 2025.

- Review your finances regularly: Check for potential deductions or credits to maximize your tax savings and avoid last-minute surprises.

- Plan ahead for extensions if needed: Filing Form 4868 gives extra time to submit your return, but doesn’t delay tax payments, so prepare accordingly.

Take Control of Your Taxes With The Madtax

Stay ahead of the 2025 tax season by organizing documents, planning payments, and meeting deadlines. The Madtax, a trusted accounting and finance firm, provides expert tax services for individuals, LLCs, and businesses, handling filings, quarterly payments, extensions, and 1099s. File confidently, avoid penalties, and maximize savings with The Madtax guiding you every step of the way.