A trial balance in accounting is a statement that lists all the ledger accounts along with their debit and credit balances at a specific point in time, helping ensure that the books are mathematically accurate. By reviewing a sample trial balance, beginners can see how accounts are organized and verify that total debits equal total credits, which is crucial for preparing accurate financial statements.

In this blog, we’ll break down the concept of a trial balance, its purpose, and how it fits into the broader accounting process, while showing how professional bookkeeping services in Houston from The Madtax can simplify managing your accounts and keep your financial records accurate.

What is a Trial Balance in Accounting

A trial balance is a bookkeeping report that lists all the accounts from your ledger along with their debit and credit balances. The main purpose of a trial balance in accounting is to check that total debits equal total credits, ensuring your books are balanced and free from simple errors. Think of it as a quick snapshot of your financial records, if the numbers match, your accounts are likely accurate.

What is the Purpose of a Trial Balance

The main purpose of a trial balance is to ensure that all financial transactions have been recorded correctly in the accounting system. A trial balance in accounting helps verify that total debits equal total credits, which is essential for detecting errors in the ledger. It also serves as a foundation for preparing accurate financial statements like the income statement and balance sheet, making it a key tool for accountants to maintain correct and organized records.

If managing your trial balance feels overwhelming, The Madtax offers expert bookkeeping services in Houston to keep your accounts accurate and up to date.

H2: What is on a Trial Balance

A trial balance contains a list of all the accounts in a company’s ledger along with their debit and credit balances. In a trial balance in accounting, you will typically see:

- Asset accounts like cash, accounts receivable, or equipment.

- Liability accounts, such as loans or accounts payable.

- Equity accounts, including capital and retained earnings.

- Revenue accounts like sales or service income.

- Expense accounts such as rent, salaries, or utilities.

The trial balance shows these balances side by side to make sure total debits equal total credits, helping confirm that the books are mathematically correct.

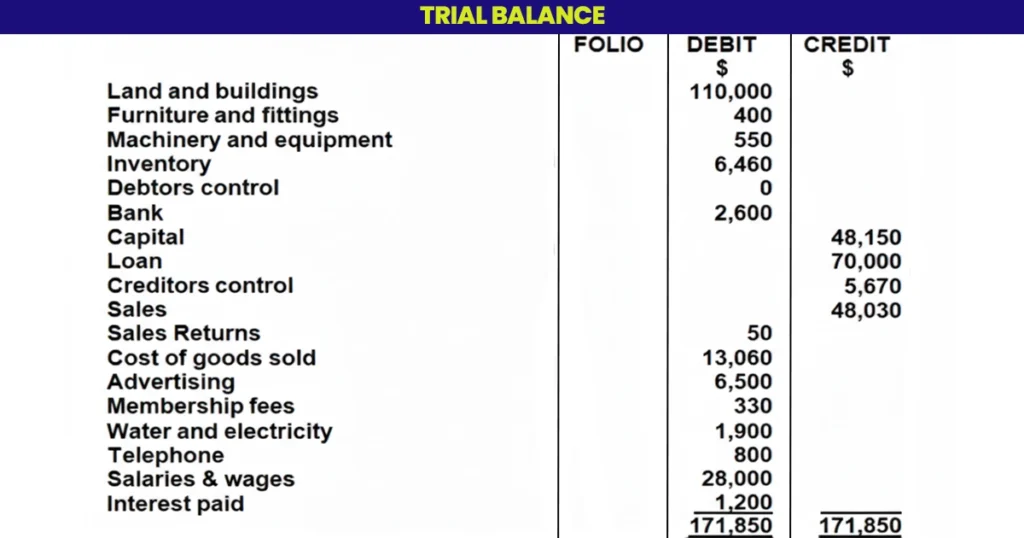

Here is a sample trial balance example:

Is the trial balance different from the balance sheet?

Yes! A trial balance is different from a balance sheet, and here’s the simple way to understand it:

- A trial balance is an internal accounting report that lists all ledger accounts with their debit and credit balances. Its main purpose in a trial balance in accounting is to check that total debits equal total credits and to catch errors before preparing financial statements.

- A balance sheet, on the other hand, is a formal financial statement that shows a company’s financial position at a specific date. It lists assets, liabilities, and equity, but does not include all revenue and expense accounts like a trial balance does.

Summary: A trial balance is a check tool for accountants, while a balance sheet is a final report used for reporting to owners, investors, or regulators.

Types of Trial Balance

In trial balance, there are different types of trial balances that accountants prepare at various stages of the accounting cycle. Each type serves a specific purpose, helping ensure the accuracy of financial records and making it easier to prepare financial statements. Understanding these types is essential for maintaining error-free accounts and a clear picture of a company’s finances.

1. Unadjusted Trial Balance

- When it’s prepared: Before any adjusting entries are made at the end of an accounting period.

- Purpose: To check if the total debits equal total credits in the ledger accounts.

- What it includes: All ledger accounts, including assets, liabilities, equity, revenue, and expenses, without considering accruals, prepayments, or depreciation.

- Why it’s important: It helps accountants detect any obvious mistakes in recording transactions before making adjustments.

- Example: If the rent expense for the month hasn’t been recorded yet, it won’t appear here, which is why adjustments are needed later.

2. Adjusted Trial Balance

- When it’s prepared: After making all adjusting entries at the end of the accounting period.

- Purpose: To ensure that the accounts are still balanced after adjustments, and it forms the basis for preparing financial statements.

- What it includes: All ledger accounts with updated balances, including adjustments for:

- Accrued expenses (expenses incurred but not yet recorded)

- Prepaid expenses (expenses paid in advance)

- Depreciation

- Accrued revenues (revenues earned but not yet recorded)

- Accrued expenses (expenses incurred but not yet recorded)

- Why it’s important: It ensures the financial statements (income statement, balance sheet) are accurate and reflect the true financial position.

3. Post-Closing Trial Balance

- When it’s prepared: After closing entries are made at the end of the accounting period.

- Purpose: To verify that permanent accounts (assets, liabilities, equity) are balanced and ready for the next accounting cycle.

- What it includes: Only permanent accounts, because temporary accounts (revenue and expenses) are closed to retained earnings or capital.

- Why it’s important: It confirms that all temporary accounts have been reset to zero for the next period and that the books are accurate for the new accounting cycle.

Pro Tip From Us: Think of the trial balance types as stages in checking your books:

- Unadjusted → First check.

- Adjusted → After corrections.

- Post-Closing → Final check before new period.

Limitations of a Trial Balance

While a trial balance is useful for checking the equality of debits and credits, it should be seen as a mathematical check rather than a guarantee that your accounting records are 100% correct.

- Cannot Detect All Errors: A trial balance will not show errors if equal debits and credits are recorded in the wrong accounts or if transactions are completely omitted.

- Cannot Detect Compensating Errors: If one mistake cancels out another (for example, overstating one account and understating another by the same amount), the trial balance will still appear balanced.

- Cannot Detect Errors of Principle: Mistakes that violate accounting principles, like recording a capital expense as a revenue expense, won’t be revealed by the trial balance.

- Cannot Detect Errors of Omission: If a transaction is completely skipped, the trial balance will still balance because it only checks totals, not completeness.

- Cannot Guarantee Accuracy of Financial Statements: Even if the trial balance balances, the accounts may still contain errors that affect the accuracy of financial reports.

Get Clear, Real-Time Financial Reports with The Madtax

Mastering a trial balance in accounting and reviewing a trial balance sheet is essential for accurate financial records, but managing it yourself can be time-consuming and confusing.

That’s where The Madtax comes in. We provide expert bookkeeping services with clear, easy-to-read reports, no accounting jargon, and real-time cloud access to your books. Let The Madtax handle your accounting so you can focus on growing your business, while always staying in control of your finances.