A clear picture of what is a bank reconciliation is critical for ensuring that your financial records accurately reflect your actual cash position. This accounting process involves comparing your internal cash records with the bank’s records and summarizing the results in a bank reconciliation statement. Any differences, such as pending deposits, outstanding checks, or bank charges, are identified and resolved to keep accounts accurate.

Through a practical bank reconciliation example, this blog will show how bank reconciliation helps prevent errors, detect discrepancies, and maintain reliable financial reporting. For professional support, The Madtax provides expert Houston bookkeeping services to keep your finances accurate and stress-free.

What Is Bank Reconciliation In Accounting?

A bank reconciliation is an accounting process used to compare a company’s or an individual’s internal cash records with the balance shown on the bank statement to ensure both are accurate and consistent.

This comparison is formally documented in a bank reconciliation statement, which highlights differences caused by timing issues, such as outstanding checks, deposits in transit, bank fees, or interest earned. Reconciliation in banking plays a crucial role in identifying errors, preventing fraud, and maintaining reliable financial records, making it an essential practice for effective cash management and accurate financial reporting.

What Is the Purpose of Bank Reconciliation?

The purpose of bank reconciliation is to ensure that the cash balance recorded in your accounting records matches the balance shown on your bank statement. By regularly reconciling these two records, businesses can identify and correct errors, such as missing transactions, duplicate entries, or incorrect amounts.

Bank reconciliation also helps detect unauthorized or fraudulent activity, track outstanding checks and deposits in transit, and maintain accurate cash flow information. Overall, it strengthens financial control, improves the reliability of financial statements, and supports better decision-making.

For professional support, The Madtax offers expert bookkeeping services in Houston to keep your finances accurate and stress-free.

What Items Appear on a Bank Reconciliation?

Several items commonly appear on a bank reconciliation, as they explain the differences between the cash balance in your accounting records and the bank statement. These include:

1. Outstanding Checks:

These are checks that a company has issued to suppliers, employees, or other parties, but which have not yet cleared the bank. Since the bank has not yet processed these payments, they are deducted from the bank’s balance during reconciliation to reflect the company’s actual cash position.

2. Deposits in Transit

Deposits recorded in the company’s books but not yet reflected on the bank statement are called deposits in transit. These could include cash or checks received near the end of the bank’s reporting period. During reconciliation, these deposits are added to the bank’s balance to match the company’s records.

3. Bank Fees

Banks often charge service fees, transaction fees, or penalties, which are automatically deducted from the account. These charges may not have been recorded in the company’s books, so they need to be accounted for during reconciliation.

4. Interest Earned

Some bank accounts earn interest, which the bank credits periodically. If this interest is not recorded in the company’s cash ledger, it must be added during reconciliation to reflect the true cash balance.

5. NSF Checks (Non-Sufficient Funds)

An NSF check is a check deposited by the company that the bank returns because the payer’s account doesn’t have sufficient funds. The bank reduces the company’s account balance, and this must be recorded in the company’s books during reconciliation. NSF checks are important because they can affect cash availability and may require follow-up with the customer.

6. Errors

Mistakes can occur either in the company’s records or on the bank’s side. Examples include misrecorded amounts, duplicate entries, or bank errors. Identifying and correcting these errors is a crucial part of the reconciliation process.

By accounting for all these items in a bank reconciliation statement, businesses can ensure that their cash records are accurate, prevent financial discrepancies, and detect potential fraud or banking errors early. Regularly reviewing these items also helps maintain healthy financial management and reliable reporting.

How Does the Bank Reconciliation Process Work?

The bank reconciliation process is a systematic way of comparing a company’s cash records with the bank statement to ensure accuracy and identify discrepancies. Here’s a step-by-step explanation of how it works:

- Obtain Bank Statement and Cash Records: The first step is to collect the latest bank statement and the company’s internal cash ledger or accounting records for the same period. This ensures you are comparing the same timeframe.

- Compare Opening Balances: Check that the opening balance in the company’s cash book matches the opening balance on the bank statement. Any differences from previous periods should have already been reconciled.

- Identify Deposits in Transit: Compare all deposits recorded in the company’s books with the deposits listed on the bank statement. Deposits recorded in the books but not yet appearing on the bank statement are deposits in transit, which will be added to the bank’s balance during reconciliation.

- Identify Outstanding Checks: List all checks that have been issued but have not yet cleared the bank. These outstanding checks are subtracted from the bank’s balance to align it with the company’s records.

- Account for Bank Charges and Interest: Check for any bank fees, service charges, or interest credited by the bank that have not been recorded in the company’s books. These items are added or subtracted from the company’s cash ledger to ensure accuracy.

- Check for NSF Checks: Identify any NSF (Non-Sufficient Funds) checks returned by the bank. These reduce the cash balance and need to be recorded in the company’s books.

- Correct Errors: Look for errors in either the company’s books or the bank statement. These could include misrecorded amounts, duplicate entries, or bank mistakes. Adjustments are made to correct these discrepancies.

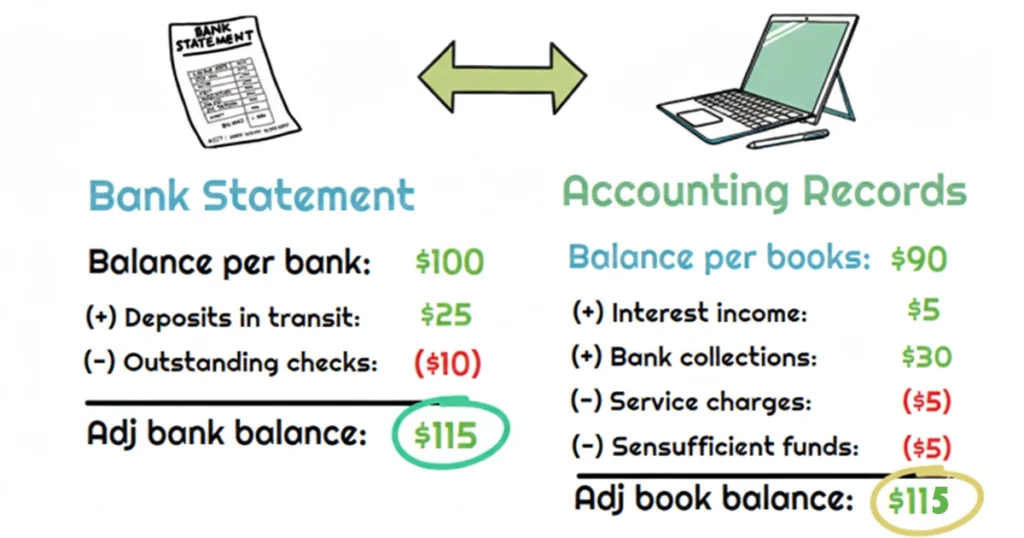

- Prepare the Bank Reconciliation Statement: After accounting for all the above items, prepare a bank reconciliation statement that shows the adjusted bank balance and the adjusted cash book balance. Both balances should now match.

- Record Adjustments in Accounting Books: Finally, make the necessary entries in the company’s cash ledger to reflect items such as bank fees, interest earned, or NSF checks. This ensures the internal records are accurate and up to date.

How to Do Bank Reconciliation – Step By Step

To perform a bank reconciliation accurately, you need a clear, organized approach. The process involves systematically reviewing both the bank statement and your cash records, identifying discrepancies, and making the necessary adjustments to ensure both balances align. Here’s a step-by-step guide:

Step 1: Obtain the Bank Statement

Start by collecting the latest bank statement from your bank and the company’s cash book or accounting records for the same period. This ensures you are comparing the same timeframe and can identify discrepancies effectively.

Step 2: Compare Bank and Cash Book Balances

Next, check the ending balance in the cash book against the ending balance on the bank statement. Any differences indicate that there are transactions that haven’t been recorded or processed by either the bank or your accounting system.

Step 3: Identify Unmatched Transactions

Look for transactions that appear in one record but not the other. Common unmatched transactions include:

- Outstanding checks – checks issued but not yet cleared by the bank.

- Deposits in transit – money recorded in your books but not yet credited by the bank.

- Bank fees or service charges – deducted by the bank but not yet recorded.

- Interest earned – added by the bank but not yet recorded.

- NSF checks – checks returned due to insufficient funds.

Step 4: Adjust the Bank Balance

Add or subtract items that affect the bank’s balance. For example, add deposits in transit and subtract outstanding checks. This adjustment helps show what the bank balance would be if all transactions were processed.

Step 5: Adjust the Book Balance

Make adjustments to the company’s cash book to account for items identified during reconciliation that have not yet been recorded, such as bank charges, interest income, or NSF checks. This ensures that the company’s records reflect the true cash position.

Step 6: Confirm Adjusted Balances Match

Finally, after adjusting both the bank and book balances, they should be equal. If they still don’t match, review the transactions carefully to ensure no item was missed or recorded incorrectly. Once the balances align, the bank reconciliation statement can be finalized, providing an accurate snapshot of cash on hand.

Let The Madtax handle your finances with expert bookkeeping services in Houston, so you can focus on growing your business.

Example of a Bank Reconciliation Statement

Let’s take a hypothetical example of a Company XYZ, which has a beginning balance of $80,000. During the month, the following transactions occurred:

- A client payment of $6,500 deposited by check.

- A check of $9,000 issued to a vendor that has not yet cleared the bank.

- A cash deposit of $4,200 made at the end of the month.

- Correction of a previous deposit recorded incorrectly by $2,000.

- Bank service fee of $75.

- Interest earned on the account: $120.

The accountant reconciles the account as follows (debits shown in parentheses, credits without parentheses):

| Transaction | Amount |

| Beginning Balance | $80,000 |

| Client check deposit | $6,500 |

| Check issued to vendor (not cleared) | ($9,000) |

| Cash deposit | $4,200 |

| Deposit error correction | ($2,000) |

| Bank service fee | ($75) |

| Interest earned | $120 |

| Adjusted Ending Balance | $79,745 |

How it works:

- The outstanding check reduces the balance because it hasn’t cleared the bank yet.

- Deposits in transit and interest earned increase the balance.

- Bank fees and error corrections decrease the balance.

- After all adjustments, the ending balance reflects the true cash available, matching the bank records once everything clears.

How Often Should You Perform Bank Reconciliation?

Bank reconciliation is an essential process for keeping your financial records accurate and detecting errors or fraud. The frequency of performing bank reconciliation depends on the size of your business, the volume of transactions, and your financial management practices. Here’s a breakdown:

1. Monthly Reconciliation (Most Common)

- Who it’s for: Small to medium-sized businesses with moderate transaction volume.

- Why: Aligns with monthly bank statements, making it easier to spot discrepancies like bank fees, missed deposits, or unauthorized transactions.

- Benefit: Keeps your books accurate without consuming excessive time.

2. Weekly Reconciliation

- Who it’s for: Businesses with higher transaction volumes (e.g., retail stores, e-commerce businesses).

- Why: Frequent reconciliation helps catch errors quickly, manage cash flow more effectively, and reduce the risk of fraud.

- Benefit: Early detection of issues can prevent financial surprises.

3. Daily Reconciliation

- Who it’s for: Large businesses or companies handling high-value transactions every day (e.g., banks, payment processors).

- Why: Ensures that your cash records are always up-to-date and discrepancies are caught immediately.

- Benefit: Critical for real-time financial control and decision-making.

4. After Significant Transactions

Even if you reconcile monthly or weekly, certain situations warrant an immediate reconciliation:

- After large deposits or withdrawals

- When closing a project or contract

- When you suspect an error or fraud

For most small businesses, monthly reconciliation is sufficient, but if you want stronger financial control or your business has frequent transactions, weekly or even daily reconciliation may be necessary.

Keep Your Books Accurate with The Madtax

In conclusion, performing regular bank reconciliation statements ensures your financial records are accurate, helps catch discrepancies early, and keeps your business running smoothly. Understanding a bank reconciliation example can make this process simple and stress-free.

For reliable and professional support, The Madtax offers expert bookkeeping services that handle your bank reconciliations and financial records with precision, so you can focus on growing your business.