Running a business means handling more than just day-to-day operations; you also need to stay compliant with taxes. For sole proprietors and freelancers, the Schedule C Form 1040 is essential. It’s where you report income, expenses, and deductions to calculate your net profit or loss. At The MadTax, our expert tax services help simplify the process so you can focus on growing your business instead of stressing about forms.

What Is Schedule C Form 1040?

Schedule C (Form 1040), Profit or Loss from Business, is used by sole proprietors, freelancers, and single-member LLCs to report income and expenses on their personal tax return. It shows the IRS your revenue, deductible expenses, and net profit or loss, which determine both income tax and self-employment tax (if net profit is $400+). You must file if you run your own business, work as a contractor, or own a single-member LLC, and separate Schedule Cs are required for multiple businesses. The form covers business details, income, expenses, cost of goods sold, vehicle use, and other deductions, with results flowing into Form 1040. Filing correctly ensures IRS compliance, maximized deductions, and accurate proof of income, while mistakes can lead to penalties or audits.

Who Needs to File Schedule C?

You must file a Schedule C if you are a sole proprietor or single-member LLC (not taxed as an S corporation). That means:

- You operate your own business (not incorporated or a partnership).

- You don’t have an employer withholding taxes from your paycheck.

- Your business’s primary goal is to earn income, not as a hobby.

- You regularly conduct business, even as a side hustle.

- You run a single-member LLC without an S corporation election.

Tip: If you have multiple businesses, you’ll need to file a separate Schedule C for each one.

How to fill out the form?

Here’s what Schedule C looks like:

What You Need Before Filling Out Schedule C

Before you dive into the form, gather:

- Your SSN or EIN (if applicable)

- Business income statement and balance sheet

- Receipts for business expenses (from office supplies to big equipment)

- Mileage logs if you use your vehicle for business

- Inventory records (if you sell products)

- Prior year tax return (for consistency)

Being organized will make the process much smoother.

How to Fill Out Schedule C Form 1040

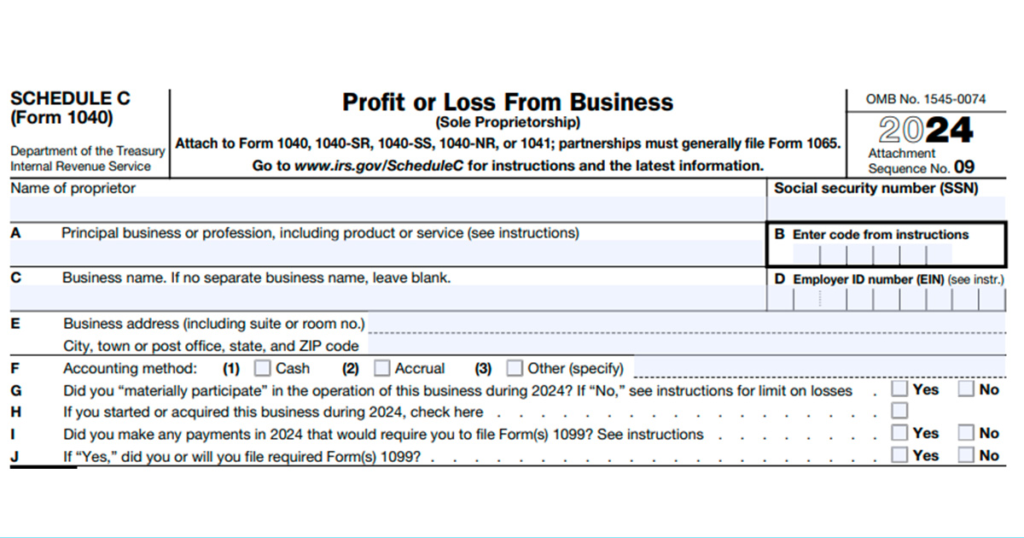

1. Sections A–J: Basic Business Info

A-B: Enter a one-line description of your business and the Principal Activity Code from IRS instructions.

F: Accounting method (cash is most common for small businesses).

G: Confirm whether you materially participated in your business (most sole proprietors will check “Yes”).

H: First year in business? Check the box.

I-J: If you paid contractors $600+, you must also file Form 1099-NEC.

D: Enter your Employer Identification Number (EIN) if you have one; otherwise, use your SSN.

E: Enter your business address—this can be your home if you work from there.

C: Provide the name of your business or leave blank if you don’t use a business name.

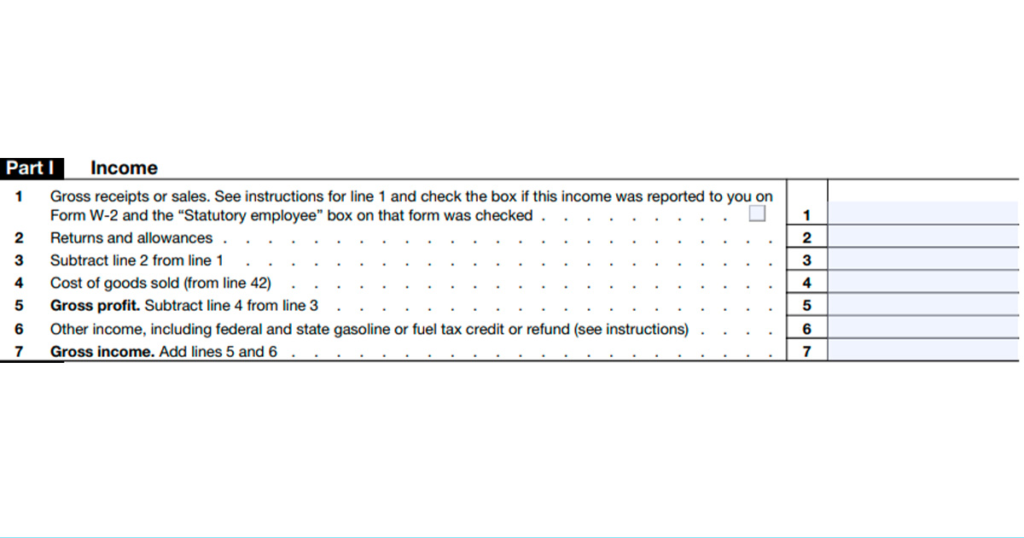

2. Part I: Income

Line 1: Gross Receipts or Sales

This is where you report your total business income before any deductions. Include payments from clients, sales revenue, and income reported on Form 1099-NEC. Do not subtract refunds, returns, or allowances here; that comes later.

Line 2: Returns and Allowances

Here, you enter the total dollar amount of refunds or discounts you gave back to customers during the year. This reduces your gross income to reflect only the money your business actually kept. If you don’t issue refunds or discounts, you can leave this line as zero.

Line 4: Cost of Goods Sold (COGS)

This line captures the direct costs of producing or selling products, such as raw materials, inventory purchases, or subcontracted labor. You’ll calculate the exact figure in Part III of Schedule C and then transfer it here.

Line 6: Other Income

This is where you list any additional income your business earned that doesn’t fit in gross receipts. Examples include interest from your business bank account, fuel tax credits, taxable grants, or awards. If you don’t have any of these, simply carry over your gross receipts amount from Line 1.

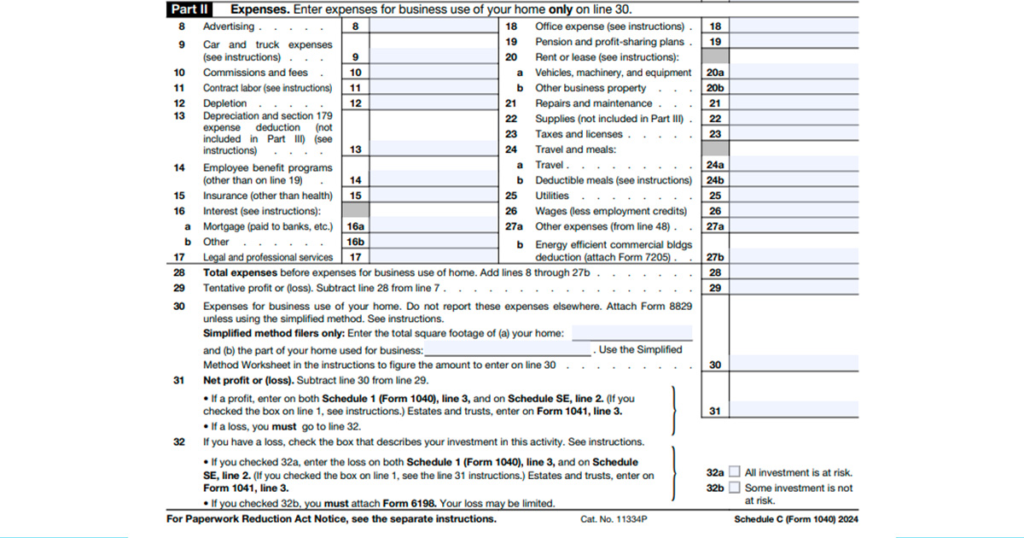

3. Part II: Expenses

Deduct all eligible business expenses:

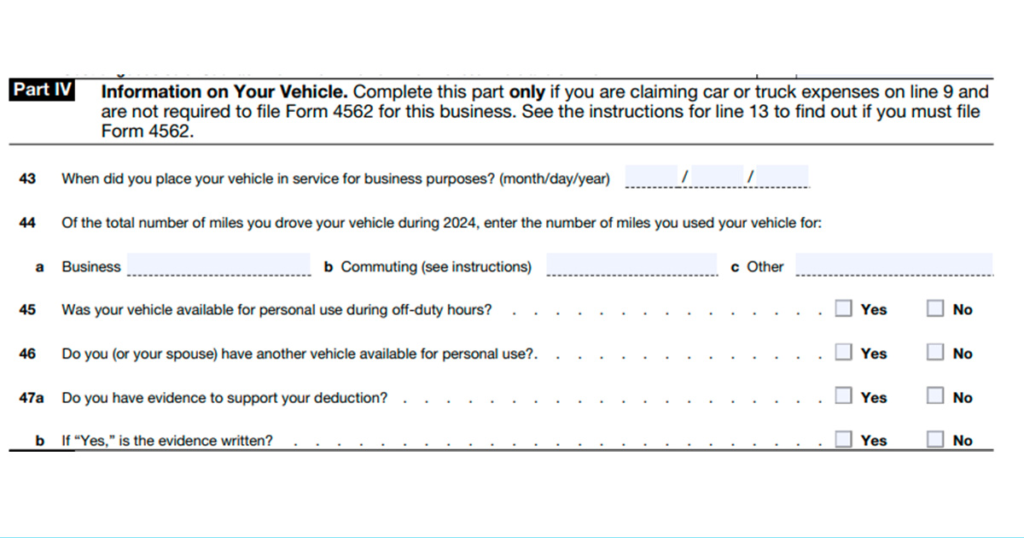

Line 9: Vehicle Expenses

Deduct business use of your car using either the IRS standard mileage rate or actual costs like gas, repairs, and insurance. Keep detailed mileage logs to stay compliant.

Line 13: Depreciation & Section 179 Deductions

Claim depreciation on assets like equipment and furniture, or use Section 179 to deduct full costs in the first year. Complex rules often require a tax pro’s guidance.

Line 18: Office Supplies

Include expenses for business-related stationery, postage, and small office tools. These everyday costs add up and directly reduce taxable income.

Line 30: Home Office Expenses

Deduct a portion of rent, mortgage, and utilities if part of your home is used exclusively for business. Choose between the simplified or actual expense method.

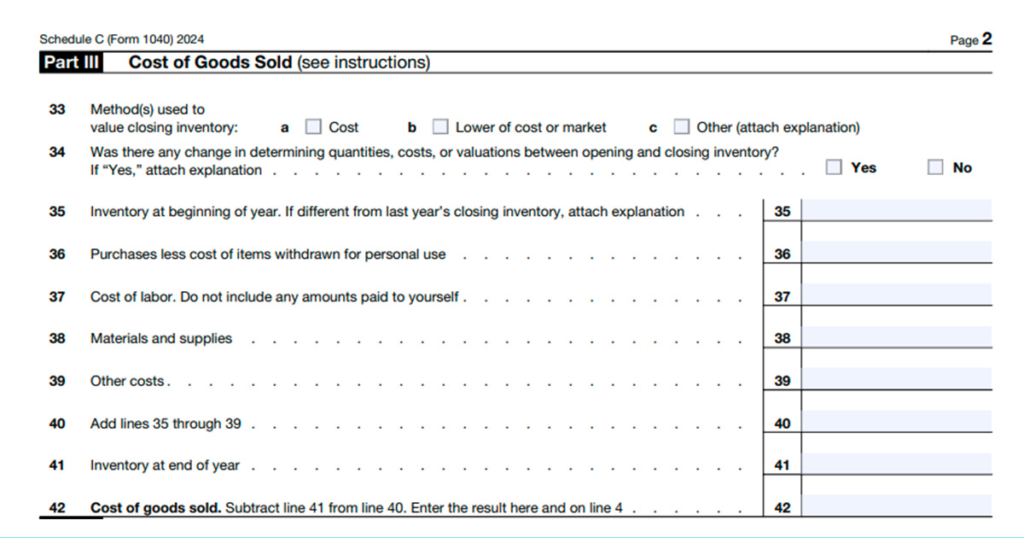

4. Part III: Cost of Goods Sold

Required if you sell products. You’ll enter:

- Beginning inventory

- Purchases (minus personal use)

- Ending inventory

- Method of valuation (usually “Cost”)

5. Part IV: Vehicle Information

If you claim car expenses, list mileage and business use percentage. Keep detailed mileage logs; estimates won’t fly with the IRS.

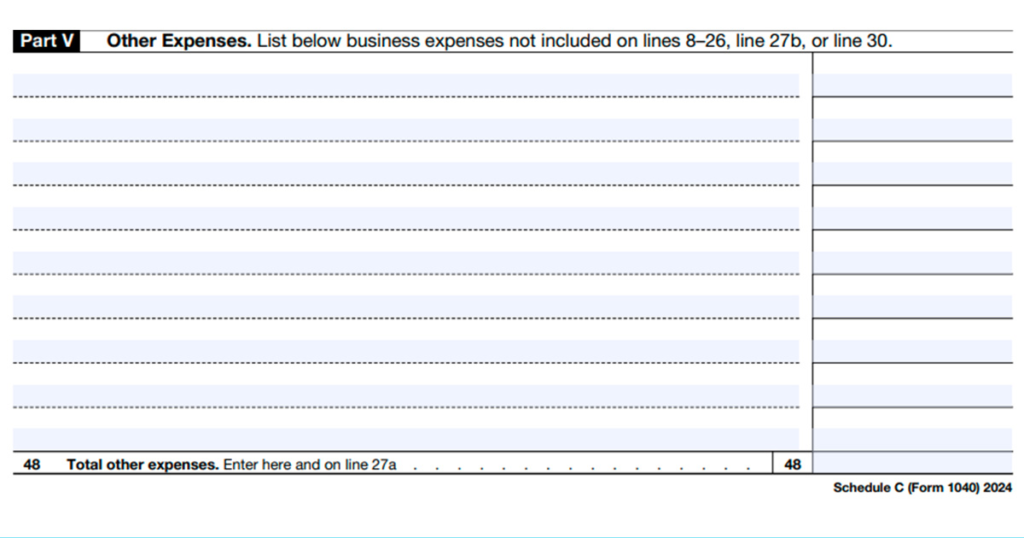

6. Part V: Other Expenses

This section is a “catch-all” for expenses not listed earlier. Examples include software subscriptions, merchant fees, or continuing education. Ambiguous expenses may lead to additional inquiries from the IRS, which taxpayers generally try to avoid.

Common Mistakes to Avoid

- Filing only one Schedule C for multiple businesses.

- Forgetting to include your SSN, even if you use an EIN.

- Missing the April 15th deadline.

- Misclassifying a business as a hobby (the IRS looks at intent, records, and regularity, not just profit).

Need Help Filing Your Schedule C Form 1040?

The Schedule C 1040 Form may look intimidating, but with the right guidance, it’s straightforward. At The MadTax, our tax experts take the stress off your shoulders, ensuring accuracy, maximizing deductions, and keeping you compliant.

Have questions about your Schedule C? Drop them in the comments below, or reach out to our team at The MadTax for expert help today! We’ll walk you through every detail, from income reporting to expense tracking. Our goal is to save you time, money, and unnecessary stress during tax season. Trust The MadTax to simplify your taxes so you can stay focused on growing your business.