Filing your taxes can sometimes feel overwhelming, especially when you are waiting for missing documents or need extra time to review your financial information. The IRS understands that taxpayers occasionally need more time to organize their records, which is why it allows individuals to request an automatic extension. By filing Form 4868, you can extend your deadline to submit your tax return by six months, giving you the breathing room you need to ensure everything is accurate and complete. However, it’s important to remember that this extension applies only to filing your return, not to paying any taxes owed.

Submitting a tax extension is a simple process, but doing it correctly is crucial to avoid penalties or interest. Whether you are self-employed, managing multiple income sources, or simply need more time to finalize your deductions, filing a tax extension can help you avoid late filing penalties and unnecessary stress. We’ll walk you through what a tax extension is, why it matters, and how our tax services can help you stay compliant, confident, and fully prepared this tax season.

What Is a Tax Extension?

A tax extension is a formal request to the IRS for more time to file your federal income tax return. It gives you an additional six months to complete and submit your tax paperwork, typically moving the deadline from April 15 to October 15. Many people confuse a filing extension with a payment extension, but they are not the same thing. The extension only allows more time to file your return, not to pay any taxes you owe. You must still estimate and pay your balance due by the original deadline to avoid interest or late payment penalties. Filing for an extension provides valuable breathing room for individuals who want to ensure their return is complete and accurate without feeling rushed.

Why File a Tax Extension?

Filing a tax extension is not uncommon and can actually be a smart move for many individuals and business owners. Here are a few reasons why you might need one:

- Missing Documents: If you’re waiting for tax forms like 1099s, K-1s, or W-2s that haven’t arrived.

- Complex Returns: When your tax situation is complicated, such as managing multiple income sources or deductions.

- Unexpected Circumstances: Illness, travel, or emergencies that prevent you from preparing your return on time.

- Avoiding Late Filing Penalties: Even if you can’t pay your full tax bill, filing an extension helps you avoid the harsher penalties for filing late.

- Better Accuracy: More time allows for careful review of deductions, credits, and income to ensure accuracy and potentially reduce your tax liability.

In short, filing an extension gives you breathing room and helps prevent costly filing mistakes.

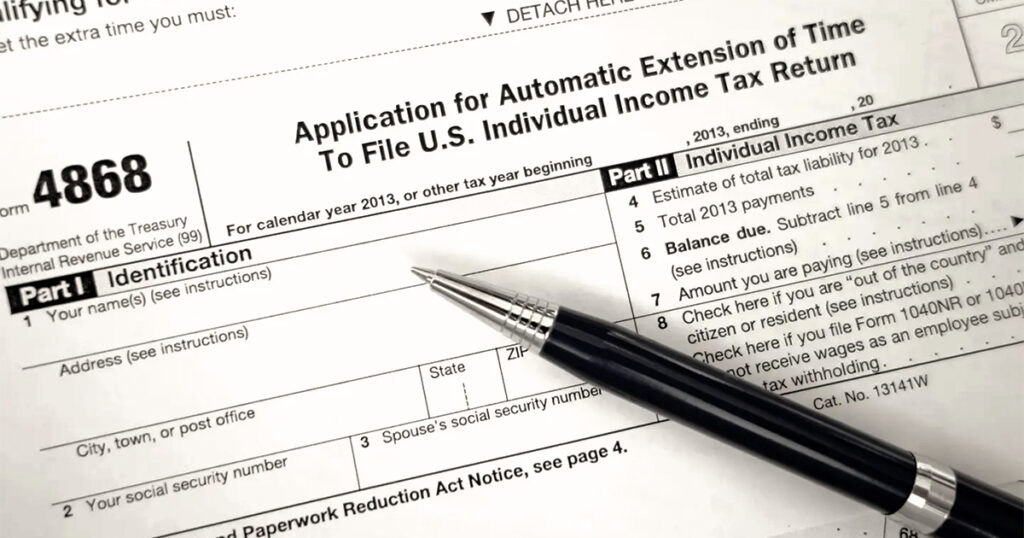

What Is IRS Form 4868?

IRS Form 4868, officially titled “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return,” is the form you use to request more time for your federal tax return. When you submit Form 4868 by the regular due date (typically April 15), you automatically receive a six-month extension, no explanation required.

You can file Form 4868:

- Electronically through the IRS e-file system or your tax software.

- By mail, using a paper form sent to the appropriate IRS address listed in the form’s instructions.

Filing electronically is faster and provides instant confirmation, while mailing may take longer and doesn’t guarantee immediate acknowledgment.

Key Deadlines for Filing a Tax Extension

Understanding the timeline is crucial to avoid penalties. Here are the key deadlines:

- Standard Tax Deadline: April 15 (or the next business day if it falls on a weekend or holiday).

- Extension Deadline: October 15 (six months after the original due date).

If you live or operate your business in an area affected by a declared natural disaster, the IRS may automatically extend your deadline, sometimes without requiring Form 4868. Always check IRS updates or consult a tax professional if you believe you qualify.

How to File a Tax Extension

Filing a tax extension is a straightforward process, but it must be done carefully to ensure acceptance by the IRS. Follow these simple steps to complete the process accurately and on time.

Step 1: Estimate Your Total Tax Liability

Before filing for an extension, you should calculate an estimate of your total tax liability for the year. Review your income, deductions, and credits to create a reasonable estimate. If you underpay significantly, you may still face interest charges even with an approved extension. Having a clear idea of your expected taxes will help you make a partial payment to the IRS and minimize potential penalties.

Step 2: Calculate Payments You Have Already Made

Next, determine how much you have already paid toward your taxes during the year. This includes any federal income tax withheld from your paycheck and any estimated tax payments you made. Subtracting these amounts from your total estimated liability will show whether you still owe money or expect a refund.

Step 3: Determine Your Balance Due

Once you know how much tax you owe, it is important to pay that balance when you submit your extension. Even though the extension delays your filing deadline, it does not delay your payment obligation. Paying your balance now helps you avoid unnecessary interest charges and late payment penalties later.

Step 4: Complete Form 4868

Form 4868 requires only basic information, including your name, address, and Social Security number. You must also enter your estimated total tax liability, the amount already paid, and any balance you are submitting with your extension request. Double-check your entries to ensure they are accurate and consistent with IRS records before submission.

Step 5: Submit Your Extension

You can file your tax extension electronically using IRS e-file, professional tax software, or a trusted tax preparer. Filing online is the fastest way to receive confirmation of approval. If you prefer to mail a paper form, send it to the appropriate IRS address listed in the official form instructions based on your state of residence.

Step 6: Make Your Payment

If you owe taxes, you can make a payment at the time you file your extension. Payments can be made using IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or with a debit or credit card. If mailing a paper form, you may also include a check or money order made payable to the United States Treasury.

Step 7: Keep Proof of Filing

After you file your extension, always save proof of submission. If you file electronically, the IRS will send confirmation that your request was received and approved. If you mail it, use certified mail or another trackable method and keep your receipt as evidence.

Does Filing a Tax Extension Affect Your Refund?

Filing a tax extension does not reduce or delay your refund. The extension only delays your deadline to file the paperwork, not the time it takes for the IRS to process your return once submitted. If you are expecting a refund, you can file anytime before the October deadline to receive it. However, it is still better to file early if possible so you can receive your money sooner. Remember that if you owe taxes, the IRS still expects payment by April 15, even if your paperwork comes later. Filing an extension helps avoid late filing penalties, but paying late can still trigger interest or additional fees.

Common Mistakes to Avoid When Filing a Tax Extension

Even though the process is straightforward, there are a few common errors that can lead to IRS issues:

- Not Paying Estimated Taxes: Remember, an extension gives you more time to file, not pay. Unpaid taxes can accumulate interest and penalties.

- Filing After the Deadline: If you miss the April 15 deadline to request an extension, late filing penalties apply.

- Incorrect or Missing Information: Ensure your name, Social Security number, and address match IRS records exactly.

- Forgetting to File State Extensions: Some states require a separate extension form in addition to the federal Form 4868. Check your state’s tax website for details.

Avoiding these mistakes helps ensure a smooth and penalty-free filing process.

What Happens After You File a Tax Extension

Once the IRS approves your extension, you’ll have until October 15 to file your tax return. During this time, you can:

- Collect and organize all necessary financial documents.

- Double-check for deductions and credits you might have missed.

- Work with a professional tax preparer for more accurate results.

If you’re still unable to file by October 15 due to special circumstances (like being overseas), you may qualify for an additional two-month extension, but this typically requires proof and IRS approval.

Filing a Business Tax Extension with Form 7004

Business owners, partnerships, and corporations do not use Form 4868. Instead, they must file Form 7004 to request an extension of time to file their business tax returns. Like Form 4868, Form 7004 gives businesses up to six additional months to file but does not grant extra time to pay. Businesses should estimate their total tax due and make payment by the original deadline to avoid penalties. Filing a business tax extension ensures compliance while allowing more time to prepare accurate and well-organized financial records.

Your Complete Financial Partner

At The Madtax, we go beyond extensions. Our professionals provide year-round bookkeeping, payroll support, and tax planning to ensure your finances stay on track. We integrate modern accounting technology with personalized expertise so your records remain accurate and audit-ready. From simple extensions to complex tax filings, our team ensures you meet every deadline with confidence. With The Madtax, your financial management becomes effortless, your taxes stay compliant, and your growth stays uninterrupted.

The Madtax – Tax Insight, Absolute Assurance

Experience peace of mind knowing your tax extensions, filings, and bookkeeping are handled by experts. At The Madtax, we simplify financial management from start to finish, so you can focus on building your future with confidence. Your path to smarter bookkeeping and worry-free tax filing begins today with The Madtax.