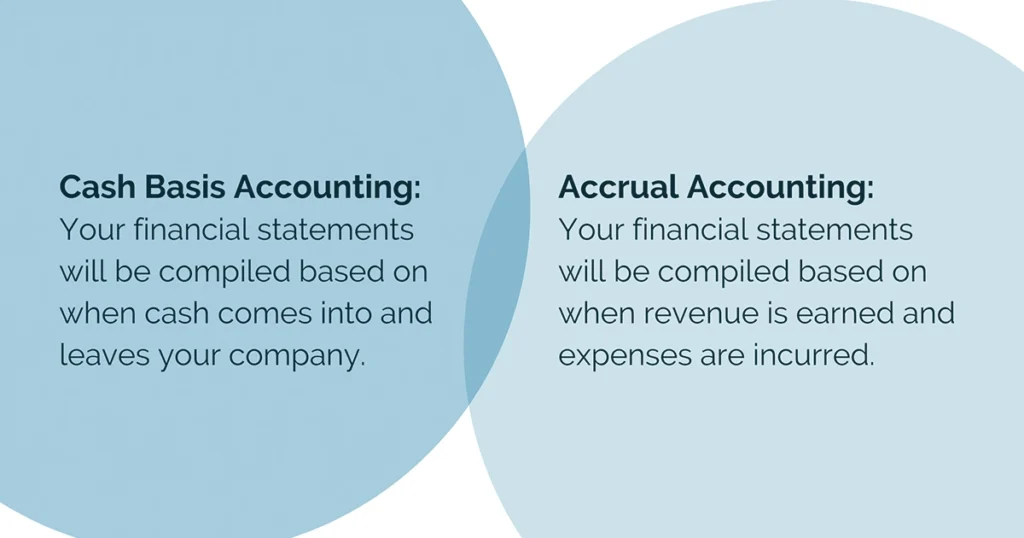

Choosing the right accounting approach is a crucial decision for any business, and understanding the differences between cash vs accrual accounting is the first step. In simple terms, the debate around accounting method, cash vs accrual, comes down to when income and expenses are recorded and how accurately they reflect your financial position.

While the cash method focuses on tracking money only when it actually moves in or out of your account, accrual accounting records transactions when they are earned or incurred.

In this blog, we’ll break down both methods clearly so you can determine which one best fits your business needs, and if you ever need help setting it up or managing your books, The Madtax makes the process simple and reliable.

What Is Cash Basis Accounting?

Cash basis accounting is an accounting method where a business records income only when cash is actually received and records expenses only when they are paid. This approach is easy to understand and closely reflects real cash flow, making it popular among small businesses and individuals who want a simple way to track finances.

However, a key limitation of cash basis accounting is that it does not account for outstanding invoices or unpaid bills, which can result in an incomplete picture of a business’s true financial position and make it harder to assess long-term profitability.

How It Works:

- Income is recorded when you receive cash (or when the money hits your bank account).

- Expenses are recorded when you pay cash (or when money leaves your account).

It doesn’t matter when you send an invoice or receive a bill—what matters is when cash is received or paid.

Simple Example Of Cash Basis Accounting

- You complete a job in March and send an invoice.

- The customer pays you in April.

- Under cash basis accounting, the income is recorded in April, not March.

The same applies to expenses:

- You receive a bill in May.

- You pay it in June.

- The expense is recorded in June.

Cash basis accounting mirrors real life and your bank balance:

- If money comes in → it’s income

- If money goes out → it’s an expense

That’s why many small businesses, freelancers, and sole proprietors prefer it.

Pros of Cash Basis Accounting

- Simple and easy to use: Straightforward to understand and maintain, especially for small businesses.

- Clear cash flow visibility: Shows exactly how much cash you have on hand at any time.

- Less bookkeeping work: Fewer rules and adjustments compared to accrual accounting.

- Helpful for tax timing: Income is taxed only when cash is received, which can help manage tax payments.

Cons of Cash Basis Accounting

- Incomplete financial picture: Does not show unpaid invoices or outstanding expenses.

- Limited long-term insight: Makes it harder to track profitability over time.

- Not suitable for growing businesses: Can become inaccurate as transactions increase.

- May not meet reporting requirements: Often not allowed for larger businesses or formal financial reporting.

What Is Accrual Basis Accounting?

Accrual basis accounting is an accounting method where income and expenses are recorded when they are earned or incurred, not when cash is received or paid. This method focuses on financial activity rather than cash movement, giving a more accurate picture of a business’s true performance.

Under accrual accounting, revenue is recognized when a product is delivered or a service is completed, even if the customer pays later. Similarly, expenses are recorded when they are owed, not when the bill is actually paid. This matching of income with related expenses helps show whether a business is truly profitable during a specific period.

Because it includes accounts like accounts receivable and accounts payable, accrual basis accounting provides a more complete view of assets, liabilities, and overall financial health. For this reason, it is commonly used by growing businesses and is required under generally accepted accounting principles (GAAP). While it is more complex than cash basis accounting, accrual accounting offers better insights for decision-making, budgeting, and long-term planning.

Simple Example Of Accrual Basis Accounting

A business completes a service for a client in March and sends an invoice for $1,000. The client pays the invoice in April. Under accrual basis accounting, the $1,000 income is recorded in March, because that’s when the service was provided—not when the cash was received.

For expenses, suppose the business receives an electricity bill of $300 in March but pays it in April. The $300 expense is recorded in March, because that’s when the expense was incurred.

This way, accrual accounting shows the true income and expenses for March, even though the cash moved in April.

Pros of Accrual Basis Accounting

- More accurate financial picture: Shows true income and expenses for a specific period.

- Better matching of revenue and costs: Helps measure real profitability.

- Improved decision-making: Provides clearer insights for budgeting and planning.

- Widely accepted standard: Required under GAAP and often preferred by investors and lenders.

- Scales well with growth: Works better for businesses with higher transaction volume.

Cons of Accrual Basis Accounting

- More complex to maintain: Requires more accounting knowledge and adjustments.

- Doesn’t reflect actual cash on hand: A business may look profitable but still face cash shortages.

- Higher bookkeeping costs: Often requires professional accounting support.

- Time-consuming: Involves tracking receivables, payables, and adjusting entries.

Cash Basis vs Accrual Basis Accounting: Key Differences

Understanding the difference between cash and accrual accounting is essential for choosing the right method for your business. While both approaches track income and expenses, they differ mainly in when transactions are recorded and how accurately they reflect financial performance.

The table below highlights the key distinctions between cash basis and accrual basis accounting in a clear, side-by-side format.

| Basis | Cash Basis Accounting | Accrual Basis Accounting |

| When income is recorded | When cash is actually received | When income is earned |

| When expenses are recorded | When cash is paid | When expenses are incurred |

| Focus | Cash flow | Financial performance |

| Accounts tracked | Cash only | Includes receivables and payables |

| Financial accuracy | Limited | More accurate and complete |

| Complexity | Simple and easy to maintain | More complex to manage |

| Cash visibility | Very clear | Less immediate visibility |

| Suitability | Small businesses, freelancers | Growing and larger businesses |

| Compliance | Not GAAP compliant | GAAP compliant |

| Decision-making | Short-term decisions | Long-term planning and analysis |

| Use of accruals and deferrals | Rarely used | Regularly used to match income and expenses |

| Use of depreciation and amortization | Not used | Used to allocate costs of assets over time |

| Use of accounts payable and accounts receivable | Not tracked | Tracked to show outstanding obligations and expected income |

| Tax reporting implications | Taxes based on cash received and paid | Taxes may be owed on earned income even if cash isn’t received yet |

Key Summary: Cash basis accounting tells you how much cash you have right now, while accrual basis accounting tells you how well your business is actually performing, even if the cash hasn’t moved yet.

Which Accounting Method Is Right for Your Business?

Choosing the right accounting method depends on the size of your business, your financial needs, and how you plan to manage your cash flow. Cash basis accounting is ideal for small businesses, freelancers, or startups that want a simple system and need to closely track cash on hand. It’s easy to manage and gives a clear view of available funds.

On the other hand, accrual basis accounting is better suited for growing businesses, companies with inventory, or those seeking investors or loans. It provides a more accurate picture of financial performance, tracks receivables and payables, and aligns with GAAP standards. Ultimately, the best method is the one that balances simplicity, accuracy, and long-term business planning.

Simplify Your Accounting with The Madtax

Choosing the right accounting method is crucial for keeping your finances accurate and your business on track. Whether you opt for cash vs accrual accounting, understanding the differences ensures you record income and expenses in the way that best supports your growth and cash flow management.

At The Madtax, we specialize in expert bookkeeping services that help businesses maintain clear, accurate records and make informed financial decisions. Let us handle your accounting so you can focus on growing your business with confidence.