Key Takeaways:

- According to the Internal Revenue Service (IRS), April 15 is the official federal filing and payment deadline for most individual taxpayers each year.

- Tax Day 2026 falls on April 15, 2026, which is the main filing deadline for most individual federal income tax returns.

- The primary tax deadline for 2026 is also the last day to pay any taxes owed for the 2025 tax year, even if you request a filing extension.

- The 1st day to file taxes for the 2025 tax year is expected to be in late January 2026, when the IRS begins accepting returns. Check out the IRS Newsroom to get updated.

- If you’re self-employed or have income without withholding, quarterly estimated taxes are due on specific dates in 2026 to avoid penalties.

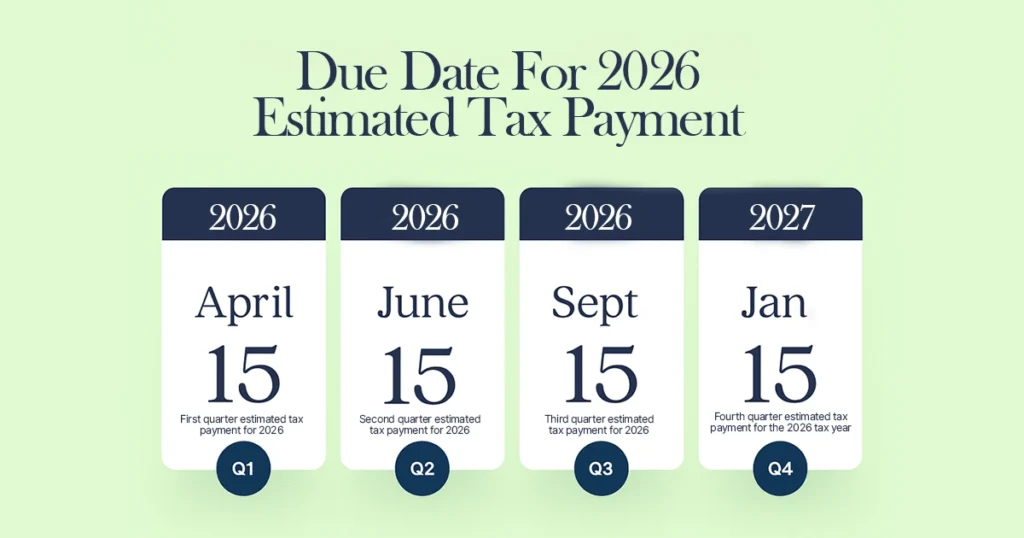

- Quarterly tax deadlines for 2026 include:

- January 15, 2026: Fourth quarter estimated tax payment for the 2025 tax year

- April 15, 2026: First quarter estimated tax payment for 2026

- June 15, 2026: Second quarter estimated tax payment for 2026

- September 15, 2026: Third quarter estimated tax payment for 2026

- January 15, 2027: Fourth quarter estimated tax payment for the 2026 tax year

- January 15, 2026: Fourth quarter estimated tax payment for the 2025 tax year

- Staying aware of these deadlines helps individuals and business owners manage cash flow and stay compliant throughout the year.

- Go through the IRS form instructions carefully to ensure accurate filing, avoid mistakes, and understand all requirements for your tax return.

- Consider professional tax services to stay compliant, meet deadlines, and maximize deductions.

What Are the Tax Deadlines for 2026?

The 2026 tax calendar includes important dates for individuals, retirees, employees, and self-employed taxpayers. Staying on top of these deadlines helps avoid penalties and ensures timely refunds.

1. Estimated Tax Payments

- January 15, 2026: Fourth quarter estimated tax payment for the 2025 tax year for self-employed individuals and those with income not subject to withholding.

- April 15, 2026: First quarter estimated tax payment for the 2026 tax year.

- June 15, 2026: Second quarter estimated tax payment for 2026.

- September 15, 2026: Third quarter estimated tax payment for 2026.

- January 15, 2027: Fourth quarter estimated tax payment for the 2026 tax year.

2. Tax Season Launch

- Late January 2026: Expected start of the 2025 tax filing season when the IRS typically begins accepting and processing returns.

3. Employer and Income Forms

- January 31, 2026:

- Deadline for employers to send W-2 forms to employees.

- Deadline to issue required 1099 forms, including Form 1099-NEC and Form 1099-MISC.

- Deadline for employers to send W-2 forms to employees.

4. Withholding Exemptions

- February 17, 2026: Deadline to reclaim exemption from tax withholding by submitting a new Form W-4 to your employer.

5. Required Minimum Distributions (RMDs)

- April 1, 2026: Deadline to take your 2025 RMD if you turned 73 in 2025.

- December 31, 2026: Deadline to take your 2026 RMD if you are age 73 or older.

6. Tax Filing and Extensions

- April 15, 2026 (Tax Day):

- Deadline to file or e-file your federal income tax return.

- Deadline for most state income tax returns.

- Deadline to request a tax extension using Form 4868 and pay any taxes owed.

- Deadline to make IRA and HSA contributions for the 2025 tax year.

- Deadline to file or e-file your federal income tax return.

7. Extended Filing Deadline

- October 15, 2026: Extended deadline to file your 2025 federal tax return if you requested an extension.

When Are Business Taxes Due in 2026?

Business tax deadlines in 2026 depend on your business structure and whether you pay estimated taxes. Below are the key dates for different business types to keep on your calendar.

1. Estimated Tax Payments

- January 15, 2026: Final estimated tax payment for the 2025 tax year for business owners and self-employed individuals who pay quarterly taxes.

- June 15, 2026: Second estimated tax payment for the 2026 tax year.

- September 15, 2026: Third estimated tax payment for the 2026 tax year.

- January 15, 2027: Fourth and final estimated tax payment for the 2026 tax year.

2. Employee Forms

- January 31, 2026:

- Employers must deliver Form W-2 to employees.

- Businesses must also send the required 1099 forms, including Form 1099-NEC and other applicable information returns.

- Employers must deliver Form W-2 to employees.

3. Partnerships, S Corporations, and Multi-Member LLCs

- March 16, 2026:

- Filing deadline for partnerships, S corporations, and multi-member LLCs taxed as partnerships using a calendar tax year.

- Required forms: Form 1065 for partnerships, Form 1120-S for S corporations.

- Last day to request a filing extension.

- Deadline to submit Form 2553 to elect S corporation status for the 2026 tax year.

- Filing deadline for partnerships, S corporations, and multi-member LLCs taxed as partnerships using a calendar tax year.

4. C Corporations, Sole Proprietors, Single-Member LLCs, and LLCs Taxed as Corporations

- April 15, 2026:

- Tax return deadline for these business types that follow a calendar year.

- Required forms:

- Deadline to request an extension for these business types.

- Tax return deadline for these business types that follow a calendar year.

If your corporation needs extra time, you can file Form 7004 to request an extension. The corporate tax extension due date for calendar-year C corporations in 2026 is October 15.

5. Nonprofit Organizations

- May 15, 2026: Tax returns due for tax-exempt nonprofit organizations that follow a calendar-year tax schedule.

- November 16, 2026: Extended filing deadline for calendar-year nonprofit organizations that requested additional time.

6. Extended Filing Deadlines

- September 15, 2026: Extended deadline for partnerships and S corporations that requested an extension.

- October 15, 2026: Final extended filing deadline for C corporations, sole proprietors, and qualifying LLCs that filed for an extension.

For businesses, knowing the corporate tax extension due date is essential. C corporations, sole proprietors, and qualifying LLCs that requested an extension must file their 2025 returns by October 15, 2026.

Estimated Quarterly Tax Due Dates for 2026

If you’re self-employed, a freelancer, an investor, or earn income that isn’t subject to tax withholding, you’re generally required to make estimated quarterly tax payments. Below are the estimated quarterly tax due dates for 2026, based on the IRS payment schedule.

- January 15, 2026: Fourth quarter estimated tax payment for the 2025 tax year (income earned from September 1 to December 31, 2025).

- April 15, 2026: First quarter estimated tax payment for the 2026 tax year (income earned from January 1 to March 31, 2026).

- June 15, 2026: Second quarter estimated tax payment for the 2026 tax year (income earned from April 1 to May 31, 2026).

- September 15, 2026: Third quarter estimated tax payment for the 2026 tax year (income earned from June 1 to August 31, 2026).

- January 15, 2027: Fourth quarter estimated tax payment for the 2026 tax year (income earned from September 1 to December 31, 2026).

Paying on time helps you avoid IRS penalties and interest and makes managing your tax obligations throughout the year much easier.

What Is the Tax Extension Deadline for 2026?

For taxpayers who need extra time to file their federal income tax return, the IRS allows a tax extension. The 2026 tax extension deadline gives you additional time to submit your completed tax return without facing late-filing penalties.

- Extended deadline to file 2025 tax returns: October 15, 2026, for most individual taxpayers who filed for an extension by April 15, 2026.

- Business tax extensions:

- Partnerships and S corporations that filed for an extension have until September 15, 2026.

- C corporations, sole proprietors, and certain LLCs that filed for an extension have until October 15, 2026.

- Tax-exempt nonprofits using a calendar year that filed for an extension have until November 16, 2026.

- Partnerships and S corporations that filed for an extension have until September 15, 2026.

Important: A tax extension gives you more time to file your return, but it does not extend the deadline to pay any taxes owed. To avoid penalties and interest, make sure any taxes due are paid by the original Tax Day 2026 on April 15, 2026.

For a comprehensive overview of all 2026 tax deadlines, refer to IRS Publication 509. If the 2026 version isn’t available yet, check back with the IRS website for the latest update.

Note: This content is intended for general informational purposes and should not be considered legal, tax, or financial advice.

Get Professional Help with Your Taxes

Navigating when taxes are due in2026, tax deadline 2026, estimated payments, and required filings can be overwhelming, especially if you have multiple income sources or run a business. The Madtax offers expert tax services to help you stay compliant, maximize deductions, and avoid costly penalties.

Whether you need assistance with federal or state tax returns, quarterly estimated taxes, or tax planning strategies, The Madtax provides reliable, professional guidance tailored to your situation. Don’t wait until the last minute—get the support you need to make tax season stress-free.

Visit The Madtax today and take control of your taxes with confidence!