If you have ever worked as an employee in the United States, chances are you will come across a W-2 form during tax season. For many people, especially those filing taxes for the first time, the W-2 may look intimidating with all of its boxes and codes. However, the truth is that the W-2 is simply a summary of how much money you earned and how much tax your employer already withheld from your paychecks, often handled through payroll processing services that keep these records accurate and organized.

The W-2 is a vital part of the tax filing process because it tells both you and the government how much of your income has already been reported and paid. Without it, you would not have an official record of your wages or the taxes that have already been taken care of. Payroll processing services make sure this information is reported correctly and delivered on time. This guide will explain step-by-step what the W-2 form is, who gets one, how to read it, and even how employers fill it out for the very first time.

Payroll Tax Definition and Basics

When people ask, “What is payroll tax?” the definition is simple: it is a tax withheld from employee wages that is matched by the employer and submitted to the government. Unlike income tax, which is based on individual circumstances, payroll tax is a flat percentage applied to wages and is specifically designated for social insurance programs. Both the employer and the employee share responsibility for funding payroll taxes. Businesses must understand the payroll tax basics to avoid compliance risks, while employees should be aware of where their contributions are going. This knowledge provides clarity when reviewing paychecks and preparing for future benefits.

Key points about payroll tax:

- Withheld directly from employee paychecks.

- Matched by employers in equal percentage.

- Funds Social Security, Medicare, and unemployment programs.

- Required by federal law for most businesses.

- Flat-rate system without deductions or exemptions.

How Payroll Tax Works for Employers and Employees

Employers serve as the link between employees and the government when it comes to payroll tax. Each time wages are paid, the employer must calculate payroll tax, withhold the correct amount, and remit both employee and employer contributions. Employees see these withholdings itemized on their pay stubs but are not responsible for sending payments directly. Payroll tax also includes federal unemployment taxes (FUTA) and, in some cases, state unemployment taxes (SUTA). Staying compliant with payroll tax laws is critical for business owners, as failure to withhold or remit properly can lead to interest charges, penalties, and even criminal liability.

Employer responsibilities include:

- Correctly calculating payroll tax based on gross wages.

- Withholding the required percentage for Social Security and Medicare.

- Matching employee contributions as required by law.

- Filing payroll tax forms with the IRS and state agencies.

- Staying updated on federal and state payroll tax changes.

Payroll Tax Rates and Contributions

Payroll tax rates are set by the federal government, though certain states may have additional requirements. As of 2025, the Social Security tax rate is 6.2% for employees and 6.2% for employers, totaling 12.4%. Medicare is 1.45% for employees and 1.45% for employers, totaling 2.9%. High earners with wages above $200,000 (single filers) or $250,000 (married filing jointly) must also pay an extra 0.9% Medicare surtax. Employers do not match this additional tax—it is the sole responsibility of the employee. Understanding these rates helps businesses maintain payroll compliance and gives employees insight into paycheck deductions.

Payroll tax rate breakdown:

- Social Security: 6.2% from employee + 6.2% from employer.

- Medicare: 1.45% from employee + 1.45% from employer.

- Additional Medicare Tax: 0.9% on high incomes (employee only).

- FUTA (Federal Unemployment): 6% on the first $7,000 of wages (employer only, reduced with credits).

- SUTA (State Unemployment): Varies by state and employer rating.

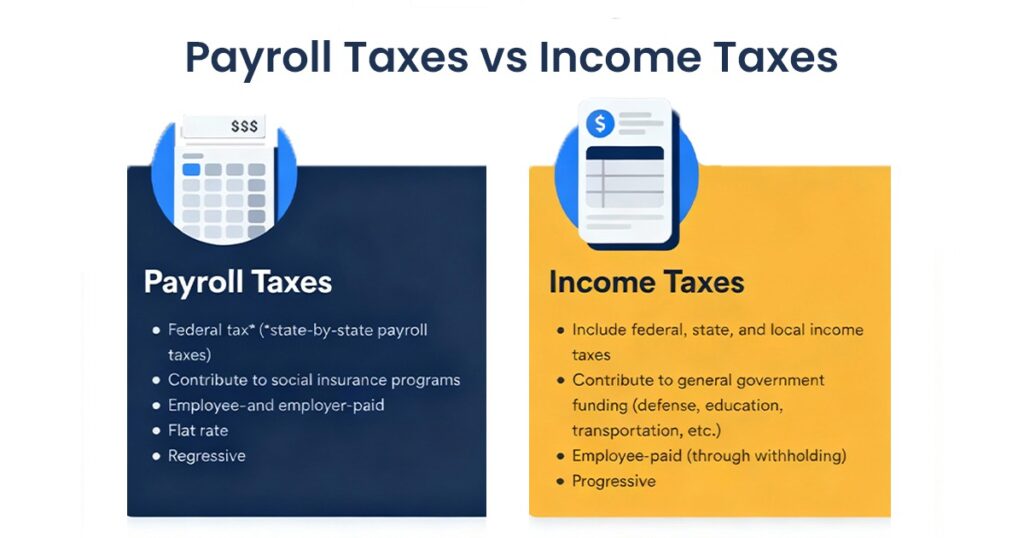

Payroll Tax vs. Income Tax

Payroll tax and income tax are often confused, but they serve different purposes and are calculated differently. Payroll tax is a flat-rate contribution specifically allocated to Social Security and Medicare, ensuring that employees receive retirement benefits and healthcare coverage in the future. Income tax, on the other hand, funds broader government operations and is based on an individual’s total taxable income. While payroll tax applies to wages without exemptions, income tax allows deductions, credits, and varying rates depending on income brackets. Employers must manage both correctly to avoid compliance issues.

Why Payroll Tax Matters for Small Businesses

Small business owners must pay special attention to payroll tax compliance. Unlike larger corporations with dedicated payroll departments, small businesses often rely on in-house staff or outsourcing to handle payroll. Errors in payroll tax can result in fines, IRS audits, and damage to employee trust. Beyond compliance, payroll taxes are essential to ensure that employees receive Social Security retirement income and Medicare benefits later in life. For business owners, understanding payroll tax creates opportunities to plan budgets effectively and avoid unexpected liabilities. Using professional payroll processing services can help streamline these tasks while ensuring accuracy.

Benefits of payroll tax compliance for small businesses:

- Avoids costly IRS fines and penalties.

- Builds employee trust by ensuring accurate benefits.

- Provides financial stability for long-term planning.

- Reduces stress by outsourcing payroll processing.

- Ensures compliance with both federal and state laws.

Simplify Payroll with The Madtax Payroll Processing Services

Managing payroll taxes can be complex and time-consuming, especially for growing small businesses. The Madtax takes the burden off your shoulders by handling payroll calculations, tax withholdings, and compliance reporting with accuracy and efficiency. Our experts adapt to your unique business needs, ensuring every payroll run is error-free and compliant with federal and state requirements. With The Madtax, you can focus on scaling your business while we handle the details of payroll tax.

Payroll Processing Services | Spend your time focusing on your product’s success while our bookkeeping experts adapt to your business needs.