Tax season often brings a flurry of paperwork and numerous forms to complete. Among the most significant for businesses is the 1099-misc form. This essential document is used to report miscellaneous income, helping individuals and businesses maintain compliance with IRS regulations. Understanding how this form works, who it applies to, and how to file it can save you time and prevent costly mistakes.

This comprehensive guide will walk you through everything you need to know about the 1099-MISC form, how it differs from the 1099-NEC, who needs to file it, and why accurate reporting matters. We’ll also explore how payroll processing services can simplify your tax filing process.

What Is Form 1099-MISC?

The 1099-MISC tax form is used to report miscellaneous income paid to individuals or businesses that are not your employees. The IRS requires this form for payments that fall outside typical wages or salaries. Common examples of payments reported on the 1099-MISC form include:

- Rent payments exceeding $600 annually.

- Prizes and awards given to non-employees.

- Medical and healthcare payments to professionals or entities.

- Attorney payments for legal services rendered.

This form is crucial for ensuring that all income is appropriately documented and reported to the IRS.

Why Is the 1099-MISC Form Important?

The 1099-MISC form serves several purposes:

- Tax Compliance: Ensures that all parties accurately report their income to the IRS.

- Transparency: Helps businesses and individuals track non-wage payments.

- Legal Protection: Filing this form protects your business from potential audits or penalties related to underreporting income.

Who Gets a 1099-MISC?

The 1099-MISC form is issued to individuals or businesses who are not your employees but receive payments that meet specific criteria set by the IRS. Here’s a detailed look at who qualifies to receive a 1099-MISC:

- Landlords

If your business pays rent exceeding $600 annually to a landlord or property owner, you must issue a 1099-MISC form. This includes payments for office spaces, warehouses, or other rented properties.

- Independent Contractors (for non-compensation income)

Although most independent contractor payments are now reported on the 1099-NEC, non-compensation-related payments (such as prizes or awards) are reported on the 1099-MISC.

- Healthcare Providers

Payments of $600 or more to healthcare professionals or entities for medical or health-related services must be reported on this form. This includes doctors, therapists, and other medical providers.

- Attorneys and Legal Professionals

Any payments made to attorneys or legal professionals, regardless of amount, for legal services rendered must be reported using the 1099-MISC form. This applies even to corporations providing legal services.

- Prize or Award Recipients

Individuals or entities receiving prizes or awards from your business valued at $600 or more are required to receive a 1099-MISC. Examples include contest winners or employee recognition awards outside of their regular wages.

- Freelancers for Non-Service Payments

Payments made for things like royalties, rent, or other non-service-based transactions should be reported on the 1099-MISC if they meet the threshold of $600.

Exceptions

- Payments made to corporations are generally exempt from the 1099-MISC requirement, except for medical and legal services.

- Payments made via third-party payment processors (e.g., PayPal or credit cards) may not require a 1099-MISC as these are often reported on a 1099-K.

1099-MISC vs 1099-NEC: Understanding the Differences

A question often raised between filers of the two forms is, what makes the 1099-MISC different from the 1099-NEC? Here’s a quick comparison. Let’s see the difference.

1099-MISC: Formerly utilized to file information about miscellaneous income such as rents received or medical costs and legal fees paid, etc. They refer to a very wide area of payment systems.

1099-NEC: Namely, the principles relating to non-employee compensation, as well as compensation received by the company from third parties.

Selecting the right form is important in order to avoid penalties, and to be able to report financial flows accurately. In this case, if you are paying individuals who are legally classified as independent contractors then bluntly speaking, you’d be correct if you use the 1099-NEC form.

Who Needs to File a 1099-MISC Form?

Businesses must issue a 1099-MISC form to individuals or entities who are:

- Landlords: Intangible rental returns consisting of $600 or higher.

- Attorneys: Paid for legal services.

- Healthcare Providers: Transferring amounts more than $600 for payment for medical related purposes.

- Prize or Award Recipients: If the total worth is getting higher than $600.

Although, any payment made to a corporation does not usually entail the issuing of a 1099-MISC form with the only exceptions being Payments for medical and legal services.

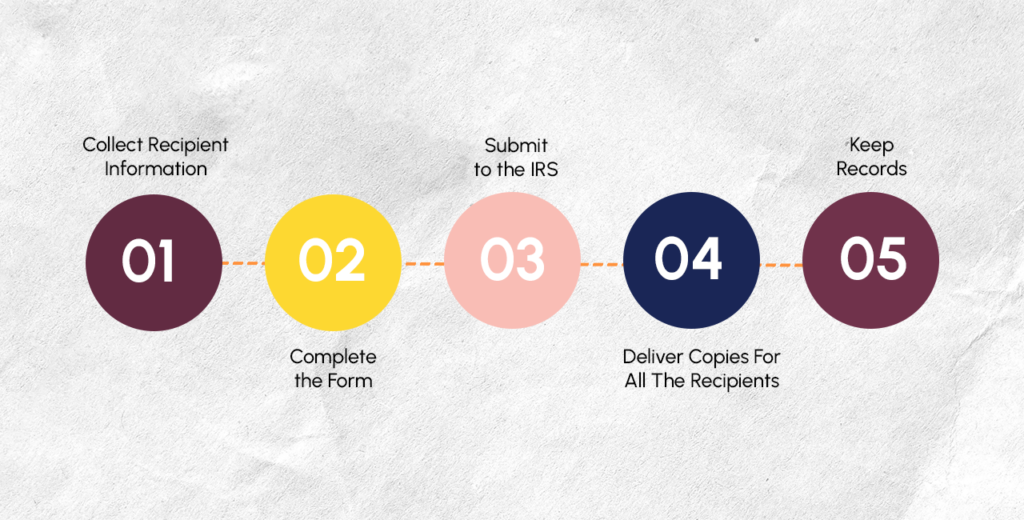

A Basic Guide to Filing Your 1099-MISC Form

The process of filing a form 1099-MISC is not complicated at all. For a smooth process, adhere to these specific steps:

Collect Recipient Information

- Get as many details as possible from the recipient, for example; the recipient’s legal name and address, and TIN number.

- Form W-9 is used to collect this information prior to the time of preparing forms to reduce wait times.

Complete the Form

You can download the 1099-MISC form from the website of the Internal Revenue Service or buy official forms in an office supplies shop.

Fill out the required fields, including:

- Payer name, and legal resident address; TIN

- Recipient’s name/signature, address, and TIN

- Payment amounts in the right box (for example, rent paid in the ten box, legal fees in the ten box).

- In order to avoid any mistakes, you should review it two times before entering any credit.

Submit to the IRS

Submit this form to the IRS through the IRS FIRE (Filing Information Returns Electronically) system only if it has been filled and signed. This one is the one that takes the shortest time and is the quickest.

Or, send the paper form to the IRS along with the instructions for Form 1099-MISC indicated on the paper form. However, if the Forms 1096 are submitted by mail, make sure you add the Form 1096.

Deliver Copies For All The Recipients

A completion of this form should be done and then a Copy B of the form would be sent to the recipient no later than 31 st January of the following tax year.

Issue usage instructions to the recipient of the form so as to guide him/her in the right process of filing his/her taxes.

Keep Records

You should keep a copy of the form together with any other supporting documents for at least 3 years.

Through outsourcing such services to payroll processing services, businesses can have a guarantee in the timely submission of the respective documents together with increased accuracy whereby less time will be used and businesses will conform to IRS regulations.

How to Get 1099-Misc Forms

You can access 1099-MISC forms through several reliable sources:

IRS Website: You can download all forms from the IRS Forms & Instructions.

Office Supply Stores: Vendors like Staples or Office Depot carry forms IRS has approved.

Payroll Processing Services: It is often easy to find payroll contractors who will be able to file the 1099-MISC for their clients.

It is very important to fill out official forms only as the photocopy or any other unofficial copy of the form is prohibited by the IRS.

Why Accurate Filing Matters

It’s also important not to make mistakes in the 1099-MISC form when filing it in order to avoid penalties. Unfortunately, the IRS also levies penalties on a tax return when the form was submitted after the due date, contains erroneous information or the necessary paperwork was not filed. Common mistakes include:

- Fill out the wrong form (for example, when it is necessary to fill out the 1099-NEC and it was filled out 1099-MISC)

- Incorrect recipient details

- Missing filing deadlines

All the details need to be correct to uphold compliance, and this way, you cannot spend money unnecessarily.

Benefits of Payroll Processing Services

Processing tax forms such as 1099-MISC can be tiresome and full of errors. Partnering with a reliable payroll processing service offers several advantages:

Accurate Reporting: Is accurate in keeping all the payment records filed properly.

Timely Filing: Completes activities that conform to the required IRS deadlines to help avert penalties.

Streamlined Process: Saves your business a lot of time and minimizes the number of administrative tasks that your business has to undertake.

Outsourcing enables you to redirect your resources and efforts to where they would be most effective: in the business’s main functions.

Make Taxation Easier through The MadTax

No one needs to tell you that tax season is no fun. It is now time to let The MadTax be your guide in preparing you for this season. Our services range from payroll processing services to solving tax compliance questions according to your business requirements.

Contact us for a call today at (855) 699- 4768.