If you’ve ever wondered “What does a bookkeeper do?” the answer goes far beyond just crunching numbers. A bookkeeper manages daily financial records, ensures accurate tracking of income and expenses, and provides the foundation for smart business decisions. Their role is essential for businesses of all sizes, from startups to established companies. Professional bookkeeping services make this process even more efficient, giving business owners peace of mind that their finances are in expert hands.

Without bookkeeping, businesses risk financial mismanagement, tax penalties, and even legal issues. In this blog, we’ll explore the roles, responsibilities, and importance of bookkeeping and when your business might need one, as well as how bookkeeping services can help you stay organized and compliant.

When Does My Business Need One?

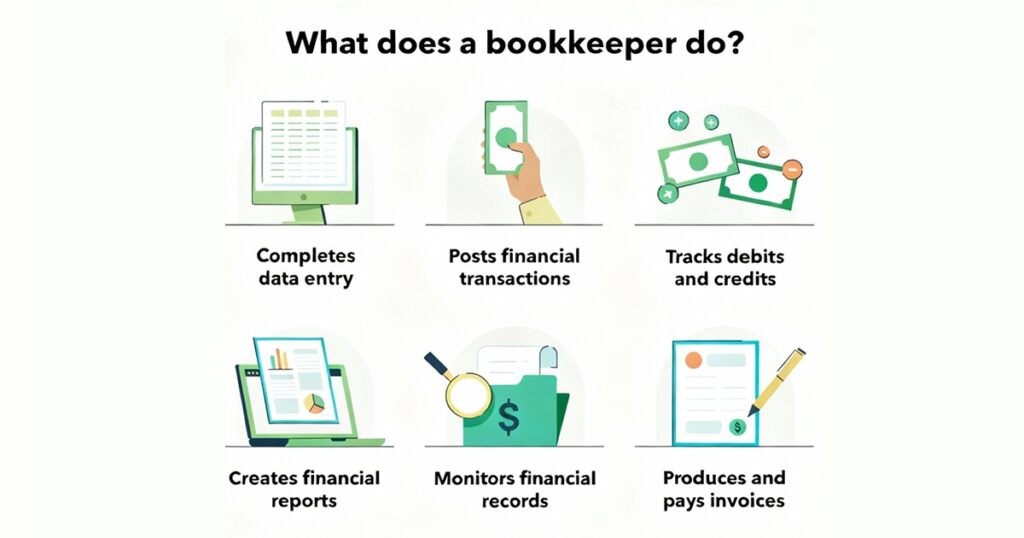

A bookkeeper is often the unsung hero behind smooth financial operations. They handle day-to-day financial tasks such as recording transactions, reconciling accounts, and managing payroll. Businesses typically need a bookkeeper when financial records become too complex for the owner to handle alone. If you find yourself spending more time on finances than on running your business, it’s a sign that you need bookkeeping support. Hiring a bookkeeper helps free up your time while ensuring accuracy and compliance.

Signs your business needs a bookkeeper:

- Struggling to keep up with daily financial tasks.

- Facing frequent errors in invoices or payments.

- Spending too much time managing cash flow.

- Missing tax deadlines or compliance requirements.

What Is a Bookkeeper?

A bookkeeper is a professional responsible for maintaining the financial heartbeat of a business. They ensure that every financial transaction, from sales to expenses, is accurately recorded and categorized. Unlike accountants, who focus on financial analysis and long-term planning, bookkeepers work with the daily details. Their work provides business owners with a clear picture of where money is coming from and where it’s going. Bookkeepers also create financial statements that are used by accountants, lenders, and investors to evaluate business health.

The Evolving Role of the Bookkeeper

Traditionally, bookkeepers worked with paper ledgers and spreadsheets, but their role has evolved with technology. Today’s bookkeepers use advanced accounting software like QuickBooks, Xero, or FreshBooks to record transactions more efficiently. Many also manage payroll, tax filings, and digital reporting, providing real-time financial insights to business owners. The evolving role of the bookkeeper reflects the increasing complexity of business finances, making them more integral than ever to modern organizations. They’re no longer just record-keepers, they’re financial partners.

Importance of Bookkeeping for Small Businesses

For small businesses, a bookkeeper is often the difference between financial chaos and clarity. Bookkeepers handle invoices, manage expenses, reconcile bank statements, and track employee payroll. These daily responsibilities keep the business running smoothly and ensure that owners can focus on growth. Small business bookkeeping also helps prevent costly mistakes such as overdrafts, missed bills, or inaccurate tax filings. By maintaining order in the books, bookkeepers help small businesses thrive.

Daily tasks of a bookkeeper for small businesses include:

- Recording sales, purchases, and expenses.

- Reconciling bank and credit card accounts.

- Generating invoices and managing receivables.

- Handling payroll and employee reimbursements.

- Preparing financial reports for owners.

What Is a Full Charge Bookkeeper?

A full charge bookkeeper goes beyond standard bookkeeping tasks by taking on more advanced responsibilities. In addition to recording transactions and reconciling accounts, they prepare financial statements, manage payroll, and may even supervise other accounting staff. They are often considered the bridge between a bookkeeper and an accountant because of their expanded skill set. Small to mid-sized businesses that cannot afford a full-time accountant may hire a full charge bookkeeper to manage all financial operations.

Responsibilities of a full charge bookkeeper include:

- Preparing monthly, quarterly, and annual financial reports.

- Managing accounts payable and receivable.

- Handling payroll taxes and compliance.

- Overseeing junior bookkeeping staff.

- Supporting external accountants during audits.

Bookkeeper vs. Accountant: What’s the Difference?

Many people use the terms bookkeeper and accountant interchangeably, but they serve different functions. Bookkeepers focus on daily financial tasks like recording transactions, while accountants analyze financial data, prepare tax filings, and provide strategic advice. In short, bookkeepers keep the records, and accountants interpret them. Both are essential, and businesses benefit most when they use bookkeepers and accountants together.

Comparison of bookkeeper vs. accountant:

- Bookkeeper: Records daily transactions, reconciles accounts, and manages invoices.

- Accountant: Analyzes financial data, prepares taxes, and offers financial planning.

- Bookkeeper’s focus: Accuracy and organization.

- Accountant’s focus: Strategy and compliance.

Do You Need a Bookkeeper if You Have QuickBooks or Other Accounting Software?

Many business owners wonder if accounting software like QuickBooks can replace a bookkeeper. While software is an excellent tool for recording and automating tasks, it cannot replace human judgment and oversight. QuickBooks may help you categorize transactions, but a bookkeeper ensures accuracy, compliance, and timely updates. A bookkeeper can also identify mistakes that software might miss, such as duplicate entries or misclassified expenses. The combination of accounting software and a skilled bookkeeper creates the strongest financial system for any business.

Why you still need a bookkeeper with software:

- Software doesn’t catch every error.

- Bookkeepers ensure compliance with tax laws.

- Human judgment adds accuracy and clarity.

- Saves owners time and stress.

When to Hire a Bookkeeper for Your Business

Knowing when to hire a bookkeeper is key to keeping your finances under control. Businesses often start without one, but as revenue grows, so do financial responsibilities. If you’re spending more than a few hours per week managing books, it’s time to bring in help. Other signs include missed payments, inaccurate reports, or difficulty preparing taxes. A bookkeeper brings peace of mind by ensuring your financial records are always accurate, up-to-date, and audit-ready.

Best times to hire a bookkeeper:

- When your business starts generating consistent revenue.

- If your financial records are disorganized.

- When you’re preparing for tax season.

- If you’re planning to apply for a business loan.

- When business growth demands professional financial management.

Streamline Your Finances with The Madtax

Managing daily finances while growing a business is challenging. That’s why The Madtax provides customized solutions to handle everything from payroll processing to day-to-day bookkeeping. Our experts keep your financial records accurate, organized, and compliant so you can focus on running your business. Whether you’re a startup or an established company, we adapt to your needs and ensure you always have a clear financial picture.

Payroll & Bookkeeping Services | Spend your time focusing on your product’s success while our experts handle the numbers with precision and care.