Think a forgiven debt is a free pass? Not so fast. If a lender cancels $600 or more of what you owe, the IRS may consider it taxable income—and that’s where the 1099-C form comes in. While debt relief can provide financial breathing room, it may also have tax consequences.

Since Form 1099-C falls under the broader Form 1099 category used for reporting various types of income, it’s essential to understand how these forms impact your tax obligations. In this guide, we’ll break down what a 1099-C form is, why you might receive one, how to determine if you owe taxes, and the steps to correctly file it.

What Is a 1099 C Form?

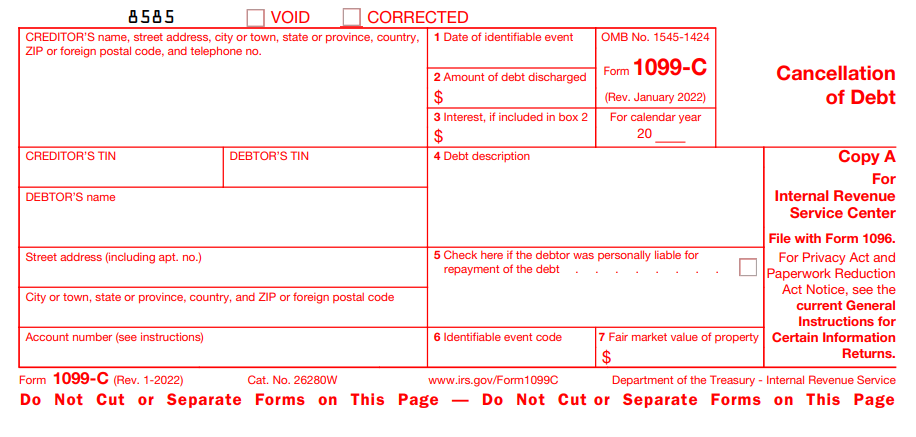

A 1099 C form, officially titled “Cancellation of Debt”, is issued by lenders when a borrower’s outstanding debt is canceled, forgiven, or discharged. The IRS requires this form because the forgiven debt is treated as taxable income unless an exclusion applies.

What Is a 1099 C Form Used For?

A 1099 C form is primarily used to report canceled debt to the IRS, ensuring that taxpayers include the forgiven amount as income on their tax returns. Common situations where a Form 1099 C is issued include:

- Credit Card Debt Forgiveness – If a credit card company forgives an unpaid balance, they must report it to the IRS if it exceeds $600.

- Mortgage Debt Cancellation – If your lender cancels your mortgage debt due to foreclosure, short sale, or loan modification, they may issue a 1099 C form (though some exclusions apply).

- Student Loan Forgiveness – In some cases, forgiven student loans (outside of programs like Public Service Loan Forgiveness) may trigger a 1099 C form.

- Settled or Discharged Debt – If you negotiate a debt settlement and the lender cancels part of your balance, the canceled portion may be taxable.

- Repossession or Foreclosure – If a lender takes possession of your car or home and forgives part of the loan balance, they must report the canceled amount.

In short, the 1099 C Cancellation of Debt form is used to notify both you and the IRS that a debt has been discharged.

How to File Form 1099 C

If you received a 1099 C form, follow these steps to ensure proper filing:

Step 1: Verify the Accuracy of the 1099 C Form

Before reporting the canceled debt on your tax return, carefully check the details on the Form 1099 C form to ensure accuracy:

- Box 1: Date of debt cancellation – This should reflect the correct date the lender discharged your debt.

- Box 2: Amount of canceled debt – This is the amount you may need to report as taxable income.

- Box 3: Interest included in the canceled debt – This indicates whether the forgiven amount included unpaid interest.

- Box 4: Debt description – This provides details on the type of debt (e.g., credit card, mortgage, or personal loan).

- Box 5: Borrower liability – If marked “checked” you were personally responsible for the debt.

- Box 6: Identifiable event code – This explains why the lender forgave the debt (e.g., foreclosure, settlement, bankruptcy).

- Box 7: Fair Market Value (FMV) of Property – If your debt involves repossession or foreclosure, this box may list the property’s FMV at the time of cancellation. This is crucial for determining potential taxable gain or loss, especially in foreclosure cases.

If you notice errors, contact the lender immediately to request corrections.

Step 2: Determine If You Owe Taxes on the Canceled Debt

Not all canceled debt is taxable. You might qualify for an exclusion under the following circumstances:

- The debt was discharged in a Title 11 bankruptcy: If your debt was eliminated through a bankruptcy proceeding, such as Chapter 7 or Chapter 13, you are not responsible for paying taxes on the forgiven amount.

- Insolvency Exclusion – If your total debts exceeded your assets before the cancellation, you may avoid taxes on the forgiven amount.

- Mortgage Forgiveness Debt Relief Act – If your primary residence was foreclosed or subject to a short sale, canceled mortgage debt may be excluded from taxation under certain conditions.

- Certain Student Loan Forgiveness Programs – If your student loan was forgiven under a qualifying program, it may not be taxable.

If you qualify for an exclusion, you must file Form 982 to officially notify the IRS.

Step 3: Report the 1099 C Amount on Your Tax Return

If your canceled debt is taxable, you must report it on your tax return:

- Individuals: Report the canceled amount on Form 1040, Schedule 1, under “Other Income” (Line 8c).

- Businesses: If the canceled debt was business-related, report it on the appropriate business tax form.

Failing to report the 1099 C Cancellation of Debt can lead to IRS penalties, audits, and additional taxes owed.

Step 4: Seek Professional Help If Needed

Filing a 1099 C form can be complicated, especially if you qualify for exclusions. Consulting a tax professional can help you:

- Accurately report the 1099 C form amount

- Minimize tax liability using exemptions

- Avoid IRS penalties for unreported income

How to Get a 1099 C Form

If a lender forgives $600 or more in debt, they must issue a 1099-C form and file it with the IRS. There are three copies of the 1099-C form:

- Copy A – Filed with the IRS by the lender.

- Copy B – Sent to you, the borrower, for tax filing purposes.

- Copy C – Retained by the lender for their records.

However, if you didn’t receive the form but believe you should have, take these steps:

- Contact the lender – Confirm whether they filed a 1099 C form with the IRS.

- Check your IRS records – If the lender reported the debt, the IRS should have a copy.

- Request a duplicate form – If you misplaced it, ask the lender for a replacement.

You don’t need to request the form yourself; lenders must provide it by January 31 of the tax year following the cancellation.

Avoiding IRS Penalties for Unreported 1099 C Debt

Failing to report a 1099 C form can result in IRS penalties, including:

- Failure to Report Income – The IRS may charge interest and penalties on unreported debt.

- Inaccurate Tax Return Penalties – If your tax return omits canceled debt, you may face additional scrutiny.

- IRS Audits – If your reported income doesn’t match the IRS records, it may trigger an audit.

To prevent issues, always verify your tax documents, consult a Guide to Form 1099, and seek professional help if necessary.

Your Guide to Tax Compliance for Canceled Debt

Receiving a 1099 C form doesn’t automatically mean you owe additional taxes, but understanding your reporting obligations is crucial. Always verify the details, determine whether you qualify for exclusions, and file accurately to avoid IRS penalties.For expert insights on tax compliance and reporting, explore our Payroll Processing Services and Tax Services to ensure your financial records are in order.