If you received health coverage through the Health Insurance Marketplace, you may be required to file Form 8962 to ensure you’re getting the correct Premium Tax Credit (PTC). This form plays a key role in reconciling any advance payments with your actual eligibility. Understanding Form 8962 and how it works is crucial to avoid delays in your tax return and to ensure that you receive the correct credit. At Madtax, we offer a wide range of tax services to help guide you through the process and answer any questions you may have.

What is Form 8962?

Form 8962 is used to claim the Premium Tax Credit (PTC), a tax benefit designed to help lower the cost of health insurance premiums for individuals and families who meet certain income requirements. The PTC is available to those who purchase health insurance through the Health Insurance Marketplace, also known as the Exchange, and who are not eligible for other affordable health coverage options.

This form helps you reconcile the amount of advance premium tax credit (APTC) you received during the year with your actual eligibility based on your tax return. If you received too much APTC, you may owe money when you file your taxes. On the other hand, if you received too little, you may be able to claim the difference as a tax refund.

Who Qualifies for the Premium Tax Credit?

You may qualify for the Premium Tax Credit if all of the following apply:

- Your household income falls within the required range, or you (or your spouse, if filing jointly) received or were approved for unemployment compensation during 2021.

- You don’t file taxes as Married Filing Separately, unless you qualify for a special exception (e.g., victims of domestic abuse or spousal abandonment).

- You aren’t claimed as a dependent on someone else’s tax return.

- In the same month, you or a family member:

- Enrolled in a Marketplace plan (not catastrophic coverage);

- Weren’t eligible for affordable employer-sponsored coverage that meets minimum value;

- Didn’t qualify for government coverage like Medicaid, Medicare, CHIP, or TRICARE; and

- Paid the portion of premiums not covered by advance payments.

- Enrolled in a Marketplace plan (not catastrophic coverage);

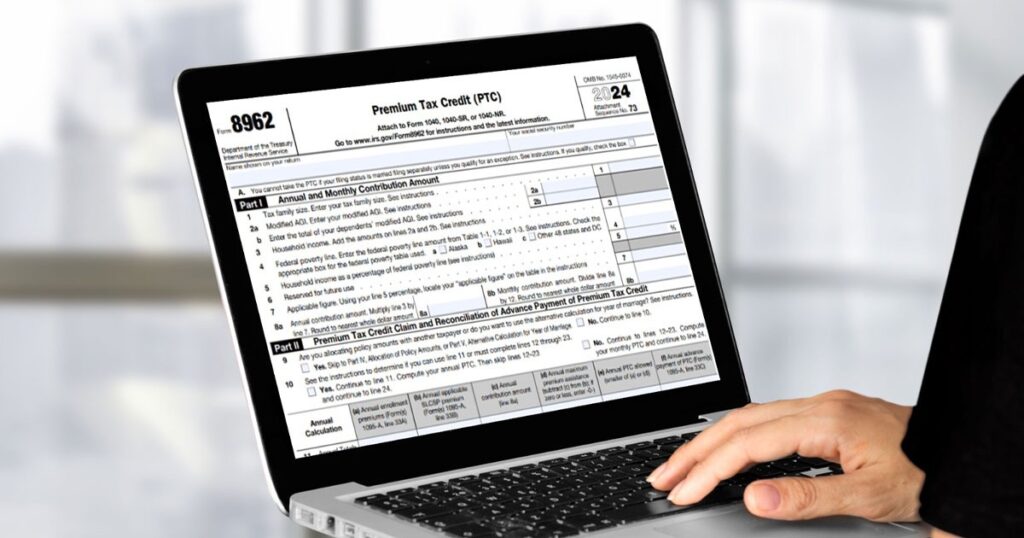

Form 8962 Instructions: How to Fill Out Form 8962

Filling out Form 8962 may seem complicated, but it’s an essential step to ensure you are receiving the correct Premium Tax Credit. Here’s a general overview of how to fill out the form:

Step 1: Gather Required Information

You’ll need Form 1095-A, which shows your premiums and any advance PTC received. Also gather your modified adjusted gross income (AGI), your dependents’ AGI (if any), and your total household size.

Step 2: Complete Part I – Contribution Amount

In Part I, enter your household size and income. Then calculate your income as a percentage of the federal poverty line. Use this to find your applicable figure and determine your expected annual and monthly contribution amounts.

Step 3: Reconcile Advance PTC (Part II)

In Part II, compare your actual PTC with what you received in advance. You can do this either annually or monthly. The form helps you calculate how much credit you were eligible for, and whether you owe anything or can claim more.

Step 4: Final Credit or Repayment (Part III)

If you received too much advance PTC, you may have to repay some or all of it. If you received too little, you can claim the difference as a refundable credit.

Step 5: File the Form

Attach Form 8962 to your tax return (Form 1040, 1040-SR, or 1040-NR). If you shared a policy with another taxpayer or got married during the year, complete Part IV or V as needed

Form 8962 Premium Tax Credit: Why is it Important?

The Premium Tax Credit is a vital part of the Affordable Care Act (ACA) and helps make healthcare coverage more affordable for those who qualify. By filling out Form 8962, you ensure that your health insurance premiums are properly accounted for, which can either lower your tax bill or increase your refund. Failure to file this form correctly can result in delays in processing your return or adjustments to your refund.

How to Get Form 8962

Form 8962 is available on the IRS website. You can download it directly from their site or access it through tax preparation software. Most tax professionals also provide this form as part of the tax filing process. You’ll need to complete the form along with your Form 1040 when filing your federal tax return.

If you’re using online tax filing tools, they often guide you through the process of completing Form 8962 as part of your tax return filing.

Why Filing Form 8962 is Essential for ACA Subsidies

The Premium Tax Credit is a significant benefit for families purchasing health insurance through the Health Insurance Marketplace. Filing Form 8962 ensures you are properly claiming the credit, which can significantly reduce your tax liability or increase your refund. Not filing the form when required can result in delays, penalties, or even the loss of your premium tax credit.

Maximize Your Premium Tax Credit with Accurate Filing

Filing Form 8962 might seem daunting, but it’s a crucial step for those who received health insurance coverage through the Marketplace. By ensuring that you file the form correctly and reconcile your Advance Premium Tax Credit, you can secure the benefits you’re entitled to, whether that means a larger refund or a reduced tax bill. Remember, accurate documentation and understanding the Form 8962 ACA explanation are key to a successful filing.

For any other tax services, including guidance on how to navigate the filing process for your specific situation, Madtax is here to help you every step of the way.