For business owners and independent contractors, understanding Form 1099-NEC is essential during tax season. This form plays a vital role in reporting nonemployee compensation, which refers to payments made to freelancers, contractors, and self-employed individuals who are not classified as employees. As the gig economy grows, more businesses and contractors are encountering this form, making it important to understand its purpose and usage.

Whether you are filing for your business or receiving the form as a contractor, knowing the ins and outs of Form 1099-NEC can save you from tax errors and potential penalties.To ensure your business remains compliant, consider outsourcing to Payroll Processing Services for accurate and efficient tax preparation.

Understanding Nonemployee Compensation

Non-employee compensation is income paid to individuals who provide services but are not employees. This classification applies to independent contractors, freelancers, and certain vendors who perform work for your business. Examples include:

- Payments to designers, writers, or photographers for specific projects.

- Fees for professional services like legal advice, consulting, or IT support.

- Commissions to sales agents operating as independent contractors.

Payments must meet specific criteria to be classified as nonemployee compensation:

- The payment is $600 or more in a tax year.

- The individual is not an employee.

- The payment is for services provided, not for goods.

- The recipient is typically an individual, partnership, or LLC taxed as a sole proprietorship.

This classification ensures independent workers report income accurately, and businesses fulfill their obligation to the IRS.

What is Form 1099-NEC Used For?

Form 1099-NEC is designed to report nonemployee compensation to the IRS and contractors. It serves two main purposes:

- For Businesses: It ensures compliance with IRS reporting requirements for payments made to independent contractors.

- For Contractors: It provides a record of income earned, which contractors use to file their taxes.

Prior to 2020, this information was reported in Box 7 of Form 1099-MISC. The IRS reintroduced Form 1099-NEC to simplify the reporting process for nonemployee compensation and avoid confusion with other types of income reported on Form 1099-MISC.

Key Details About Form 1099-NEC

- Who Must File It?

Any business that pays $600 or more to an independent contractor in a calendar year must file Form 1099-NEC. This includes sole proprietors, partnerships, and corporations. - Who Receives It?

Independent contractors, freelancers, or vendors who are not employees of the business and who have been paid $600 or more during the year. - Filing Deadline:

The IRS requires Form 1099-NEC to be submitted by January 31 for both the IRS and the contractor.

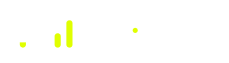

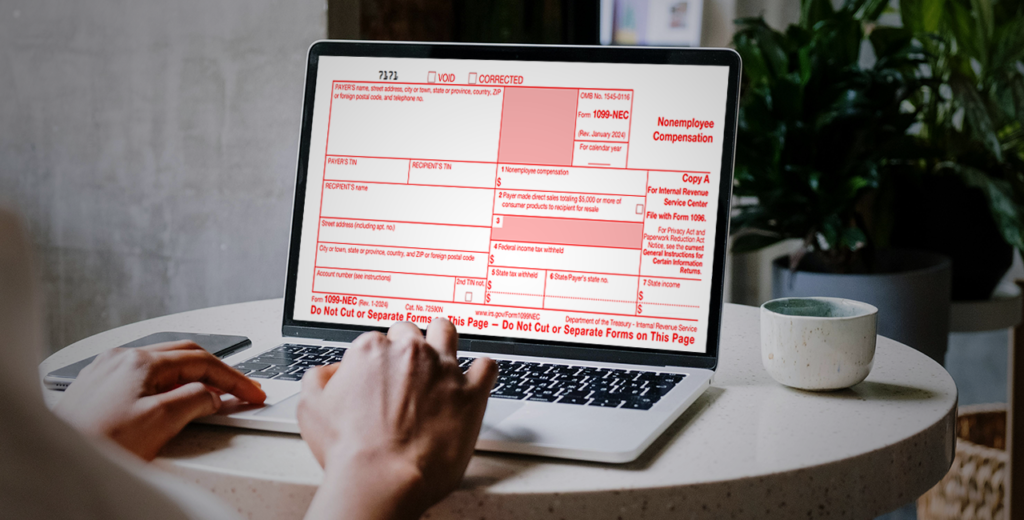

How to Fill Out a 1099-NEC Form

Filling out Form 1099-NEC might seem daunting at first, but breaking it down into steps makes it manageable. Here’s what you need to do:

- Gather Information:

Collect the contractor’s full legal name, address, and taxpayer identification number (TIN). Verify this information using a Form W-9, which contractors should complete before starting work. - Complete Payer Details:

Enter your business name, address, and TIN. - Enter Payment Amount:

Report the total nonemployee compensation paid to the contractor in Box 1. - Include Tax Withholding (If Applicable):

If you withheld any federal or state taxes from payments, record them in the respective boxes. - Distribute Copies:

- Copy A: Submit to the IRS.

- Copy B: Send to the contractor.

- Copy C: Keep for your records.

- File Electronically or by Mail:

If you file 10 or more forms, electronic filing is mandatory. For fewer forms, you can opt for paper filing, but ensure all documents reach the IRS by the January 31 deadline.

IRS Penalties for Incorrect or Late Tax Filing: What You Need to Know

The Internal Revenue Service (IRS) imposes penalties for both late filing and late payment of taxes. The Failure to File penalty is typically 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25% of the unpaid taxes. If the return is more than 60 days late, the minimum penalty is either $485 or 100% of the unpaid tax, whichever is less.

The Failure to Pay penalty is generally 0.5% of the unpaid taxes for each month or part of a month following the due date, also capped at 25%. If both penalties apply in the same month, the Failure to File penalty is reduced by the amount of the Failure to Pay penalty for that month, resulting in a combined penalty of 5% per month.

Additionally, the IRS charges interest on both penalties and any unpaid taxes, with rates subject to change quarterly. Interest accrues daily from the due date of the return until the total balance is paid in full.

To avoid these penalties, it’s crucial to file tax returns and pay any owed taxes by the designated deadlines. If unable to do so, taxpayers should consider filing for an extension or setting up a payment plan to mitigate potential penalties and interest.

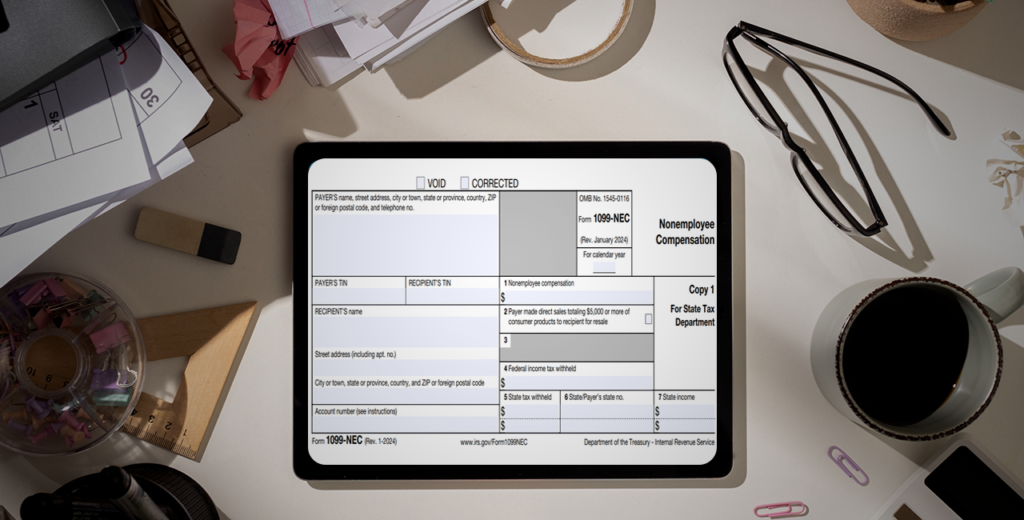

Where to Send 1099-NEC Forms

The submission process for Form 1099-NEC involves multiple recipients:

- IRS: Submit Copy A via mail or electronically. Electronic filing is faster, more secure, and mandatory for businesses filing 10 or more forms.

- State Agencies: Some states require 1099-NEC filings, so check your state’s regulations to ensure compliance.

- Contractor: Provide Copy B to the contractor by January 31. Use secure delivery methods to ensure timely receipt.

If managing these submissions feels overwhelming, professional Tax Services can help ensure your forms are filed correctly and on time.

1099-NEC vs 1099-MISC: Key Differences Explained

The 1099-NEC and 1099-MISC serve different purposes. The 1099-NEC is exclusively for reporting nonemployee compensation, such as payments to independent contractors, and is due by January 31. The 1099-MISC covers other miscellaneous income like rent, royalties, and prizes. While 1099-NEC focuses solely on services, 1099-MISC handles a broader range of payments. Both are vital for tax compliance but target different types of income. Accurate filing ensures IRS regulations are met.

Common Mistakes to Avoid

Mistakes when filing Form 1099-NEC can lead to penalties and unnecessary stress. Here are common errors to avoid:

- Missing Deadlines:

Late submissions can result in penalties ranging from $50 to $280 per form, depending on the delay. - Providing Incorrect Information:

Errors in TINs, names, or payment amounts can cause filing rejections and penalties. Always verify contractor details with Form W-9. - Failing to Issue a Form:

Some businesses mistakenly think they don’t need to issue 1099-NEC forms for small payments. If the total exceeds $600 in a year, a form is required. - Not Filing for All Contractors:

Businesses sometimes overlook issuing forms to contractors who perform one-time services. All eligible payments must be reported. - Misclassifying Employees as Contractors:

Misclassifying workers can lead to audits and penalties. Ensure proper classification under IRS guidelines.

Why Nonemployee Compensation Reporting Matters

Reporting nonemployee compensation ensures compliance with tax regulations for both businesses and contractors. For businesses, it helps maintain accurate records and reduces audit risks. For contractors, receiving a 1099-NEC tax form ensures they can file their taxes accurately, avoiding underpayment or penalties.

The IRS uses these forms to match reported income with tax returns, so inaccuracies or omissions can trigger audits or fines.

Benefits of Professional Assistance

Managing tax forms like the 1099-NEC can be challenging, especially for businesses working with multiple contractors. Professional payroll and tax preparation services can:

- Ensure accurate and timely preparation.

- Minimize the risk of penalties through error-free documentation.

- Save time by handling compliance-related preparation tasks on your behalf.

Partnering with experts lets you focus on running your business while ensuring your tax obligations are met.

Summary

Understanding and properly managing Form 1099-NEC is crucial for businesses that work with independent contractors. From identifying eligible payments to preparing accurate forms, attention to detail is essential to avoid mistakes and penalties.

For accurate and stress-free tax form preparation, consider leveraging Payroll Processing Services for comprehensive support. Our services focus on preparing tax forms accurately, ensuring compliance with IRS guidelines. By staying informed and organized, you can maintain smooth operations and avoid complications during tax season.

Ensure Accurate 1099-NEC Preparation Today!

Simplify your 1099-NEC process with expert assistance. Our team ensures accurate preparation of nonemployee compensation reports, compliance with IRS guidelines, and error-free documentation. Save time and avoid penalties with our professional preparation services. Let us handle your tax forms while you focus on growing your business. Contact us now to get started!